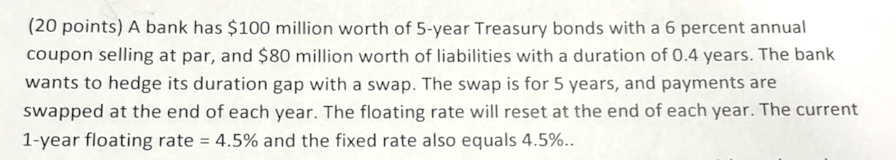

Question: ( 2 0 points ) A bank has $ 1 0 0 million worth of 5 - year Treasury bonds with a 6 percent annual

points A bank has $ million worth of year Treasury bonds with a percent annual coupon selling at par, and $ million worth of liabilities with a duration of years. The bank wants to hedge its duration gap with a swap. The swap is for years, and payments are swapped at the end of each year. The floating rate will reset at the end of each year. The current year floating rate and the fixed rate also equals Find the amount of the swap to effectively hedge against the interest rate risk on the value of the bank's equity. Based on your answer to the first question, does the bank need to buy or sell the swap? Provide a qualitative explanation for how this position helps the bank hedge its interest rate risk.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock