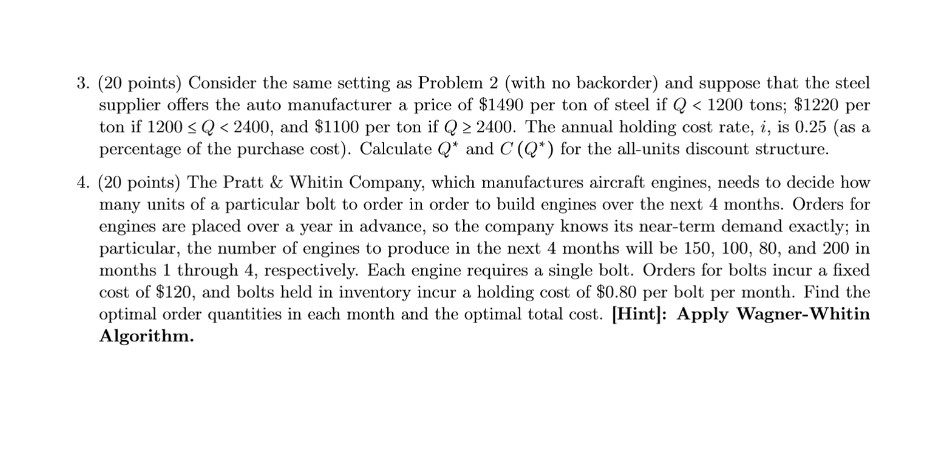

Question: ( 2 0 points ) Consider the same setting as Problem 2 ( with no backorder ) and suppose that the steel supplier offers the

points Consider the same setting as Problem with no backorder and suppose that the steel supplier offers the auto manufacturer a price of $ per ton of steel if tons; $ per ton if and $ per ton if The annual holding cost rate, is as a percentage of the purchase cost Calculate and for the allunits discount structure.

points The Pratt & Whitin Company, which manufactures aircraft engines, needs to decide how many units of a particular bolt to order in order to build engines over the next months. Orders for engines are placed over a year in advance, so the company knows its nearterm demand exactly; in particular, the number of engines to produce in the next months will be and in months through respectively. Each engine requires a single bolt. Orders for bolts incur a fixed cost of $ and bolts held in inventory incur a holding cost of $ per bolt per month. Find the optimal order quantities in each month and the optimal total cost. Hint: Apply WagnerWhitin Algorithm.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock