Question: ( 2 0 % ) ( Stocks ) Fincorp will pay a yearend dividend of $ 2 . 4 0 per share, which is expected

Stocks Fincorp will pay a yearend dividend of $ per share, which is expected to grow at a rate indefinitely. The discount rate is

a What is the stock selling for?

b If total earnings are $ a share, what must be the plow back ratio of the firm?

c What must be the return on equity for Fincorp shares?

d What is the max dividend the company can pay if it decides not to retain any earnings?

e What is the price per share if the company decides not to retain any earnings?

f Calculate the present value of growth opportunities for this firm.

g Is it a good idea for the manger to issue the yearend dividend? Briefly explain.

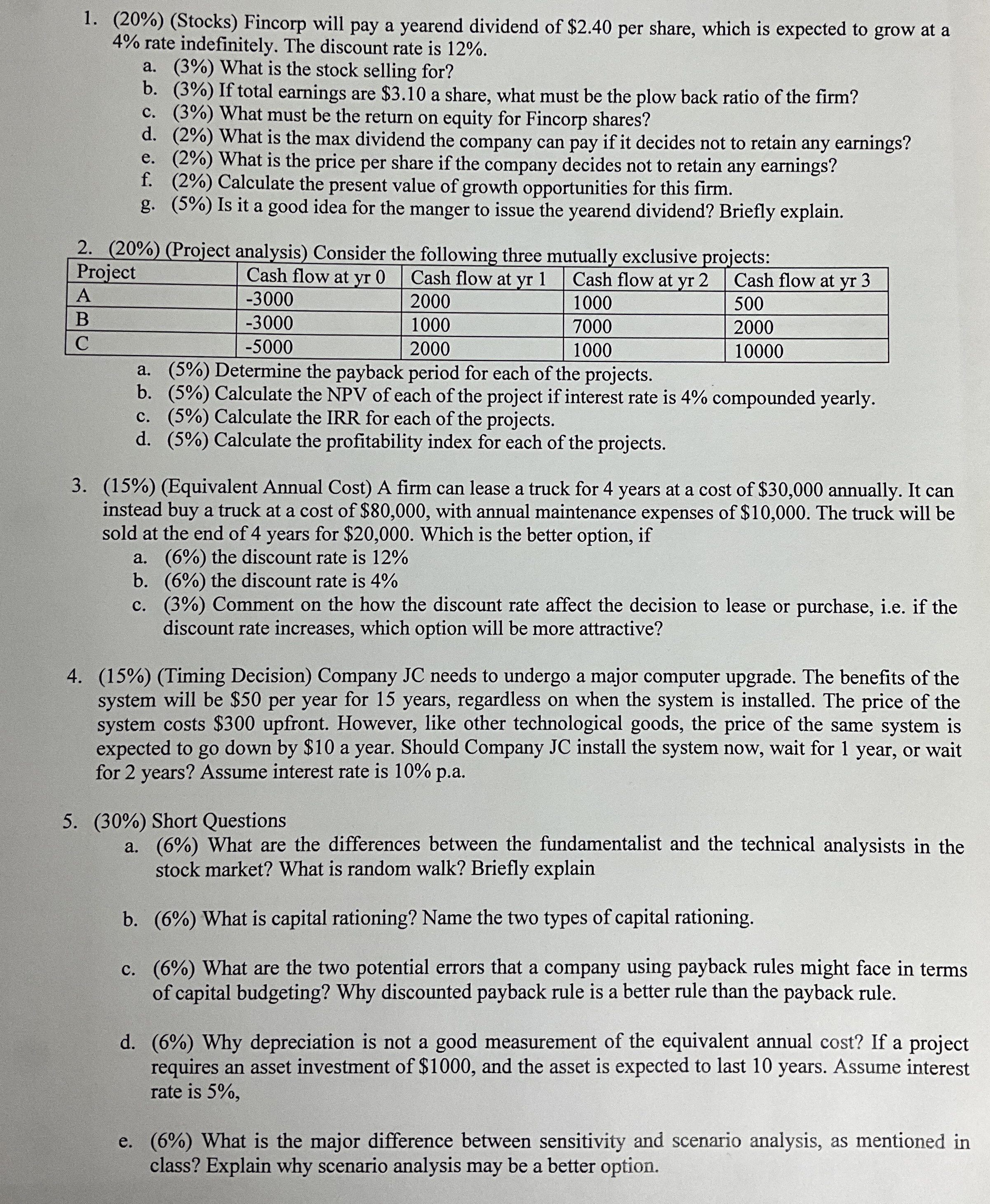

Project analysis Consider the following three mutually exclusive projects:

tableProjectCash flow at yr Cash flow at yr Cash flow at yr Cash flow at yr ABC

a Determine the payback period for each of the projects.

b Calculate the NPV of each of the project if interest rate is compounded yearly.

c Calculate the IRR for each of the projects.

d Calculate the profitability index for each of the projects.

Equivalent Annual Cost A firm can lease a truck for years at a cost of $ annually. It can instead buy a truck at a cost of $ with annual maintenance expenses of $ The truck will be sold at the end of years for $ Which is the better option, if

a the discount rate is

b the discount rate is

c Comment on the how the discount rate affect the decision to lease or purchase, ie if the discount rate increases, which option will be more attractive?

Timing Decision Company JC needs to undergo a major computer upgrade. The benefits of the system will be $ per year for years, regardless on when the system is installed. The price of the system costs $ upfront. However, like other technological goods, the price of the same system is expected to go down by $ a year. Should Company JC install the system now, wait for year, or wait for years? Assume interest rate is pa

Short Questions

a What are the differences between the fundamentalist and the technical analysists in the stock market? What is random walk? Briefly explain

b What is capital rationing? Name the two types of capital rationing.

c What are the two potential errors that a company using payback rules might face in terms of capital budgeting? Why discounted payback rule is a better rule than the payback rule.

d Why depreciation is not a good measurement of the equivalent annual cost? If a project requires an asset investment of $ and the asset is expected to last years. Assume interest rate is

e What is the major difference between sensitivity and scenario analysis, as mentioned in class? Explain why scenario analysis may be a better option.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock