Question: 2 05.2 010 12 14 16 18 20 -> A Moving to another question will save this response. Question 22 Which of the following correctly

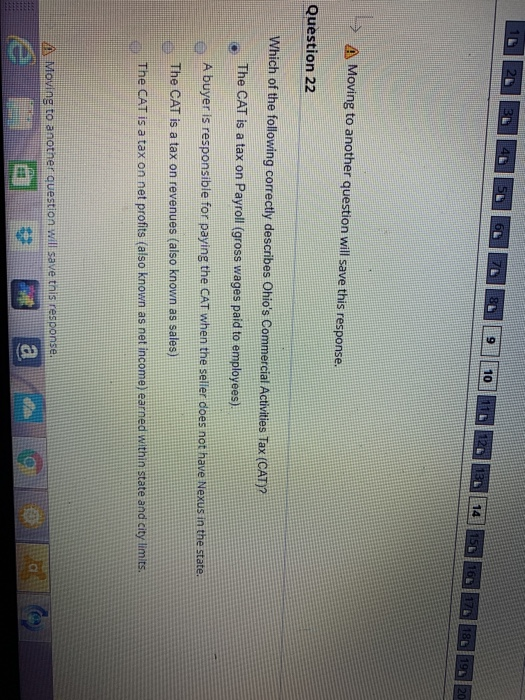

2 05.2 010 12 14 16 18 20 -> A Moving to another question will save this response. Question 22 Which of the following correctly describes Ohio's Commercial Activities Tax (CAT)? The CAT is a tax on Payroll (gross wages paid to employees). A buyer is responsible for paying the CAT when the seller does not have Nexus in the state. The CAT is a tax on revenues (also known as sales) The CAT is a tax on net profits (also known as net income) earned within state and city limits. Moving to another question will save this response e ta a lo

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock