Question: 2 1 , 0 0 0 7 0 , 0 0 0 Inventory 4 5 , 0 0 0 Store equipment 3 0 0 ,

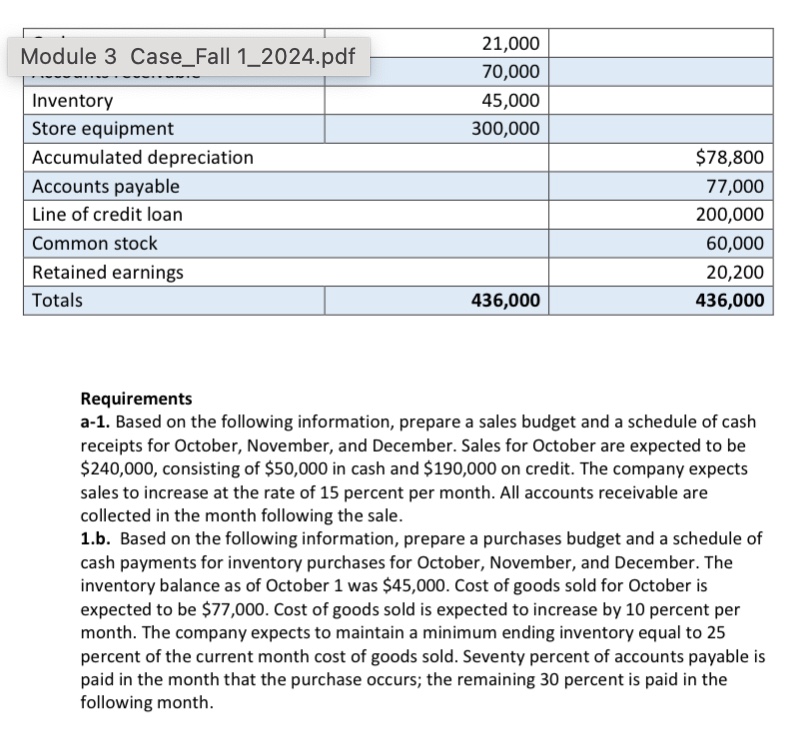

Inventory Store equipment Accumulated depreciation $ Accounts payable Line of credit loan Common stock Retained earnings Totals

Requirements

a Based on the following information, prepare a sales budget and a schedule of cash receipts for October, November, and December. Sales for October are expected to be $ consisting of $ in cash and $ on credit. The company expects sales to increase at the rate of percent per month. All accounts receivable are collected in the month following the sale.

b Based on the following information, prepare a purchases budget and a schedule of cash payments for inventory purchases for October, November, and December. The inventory balance as of October was $ Cost of goods sold for October is expected to be $ Cost of goods sold is expected to increase by percent per month. The company expects to maintain a minimum ending inventory equal to percent of the current month cost of goods sold. Seventy percent of accounts payable is paid in the month that the purchase occurs; the remaining percent is paid in the following month.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock