Question: [ 2 1 . 1 6 ( to 3 ) Error Anahyh and Correcting Entry. You have been engaged to review the financial statements of

to Error Anahyh and Correcting Entry.

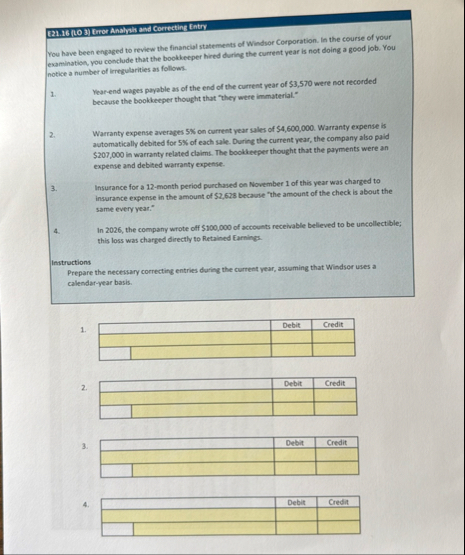

You have been engaged to review the financial statements of Windsor Corporation. In the course of your examination, you conclude that the bookkeeper hired during the current year is not doing a good job. You notice a number of irregularities as follows.

Yearend wages payable as of the end of the current year of $ were not reconded because the bookkeeper thought that "they were immaterial."

Warranty expense averages on current year sales of $ Warranty expense is automatically debited for of each sale. During the current year, the company also paid $ in warranty retated chalms. The boolkeeper thought that the payments were an expense and debitid warranty expense.

Insurance for a month period purchased on November of this year was charged to insurance expense in the amount of $ becave "the amount of the check is about the same every year."

In the company wrote off $ of accounts receivable believed to be uncollectible; this loss was charged directly to Retained Earnings.

Instructions

Prepare the necessary correcting entries during the current year, assuming that Windsor uses a calendaryear basis.

tableDebit,Credit

tableDebit,Credit

tableDebit,Credit

tableDebit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock