Question: 2. [10 points] You are analyzing the variables that explain the monthly returns on the stock of the Boeing Company with the following regression model

![2. [10 points] You are analyzing the variables that explain the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671408d727a74_230671408d6c132e.jpg)

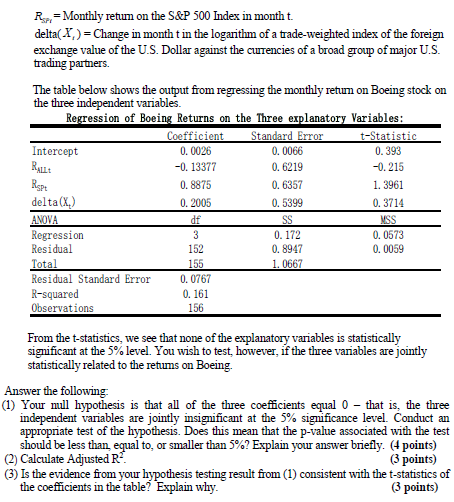

2. [10 points] You are analyzing the variables that explain the monthly returns on the stock of the Boeing Company with the following regression model for the period of 1990 - 2002: R = b + Run +b, Ra+bdelta(x)+8, R = Monthly retum on the stock of Boeing in month t. Rau= Monthly return on a value-weighted index of all the companies listed on the NYSE, AMEX, and Nasdaq in month t. R = Monthly retum on the S&P 500 Index in month t. delta(X) = Change in month t in the logarithm of a trade-weighted index of the foreign exchange value of the U.S. Dollar against the currencies of a broad group of major U.S. trading partners. The table below shows the output from regressing the monthly retum on Boeing stock on the three independent variables. Regression of Boeing Returns on the Three explanatory Variables: Coefficient Standard Error t-Statistic Intercept 0.0026 0.0066 0.393 RALLE -0. 13377 0.6219 -0.215 Rispt 0.8875 0.6357 1. 3961 delta (X) 0.2005 0.5399 0.3714 ANOVA df MSS Regression 3 0.172 0.0573 Residual 152 0.8947 0.0059 Total 155 1. 0667 Residual Standard Error 0.0767 R-squared 0.161 Observations 156 From the t-statistics, we see that none of the explanatory variables is statistically significant at the 5% level. You wish to test, however, if the three variables are jointly statistically related to the retums on Boeing. Answer the following (1) Your nul hypothesis is that all of the three coefficients equal 0 - that is, the three independent variables are jointly insignificant at the 5% significance level. Conduct an appropriate test of the hypothesis. Does this mean that the p-value associated with the test should be less than equal to, or smaller than 5%? Explain your answer briefly. (4 points) (2) Calculate Adjusted R (3 points) (3) Is the evidence from your hypothesis testing result from (1) consistent with the t-statistics of the coefficients in the table? Explain why. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts