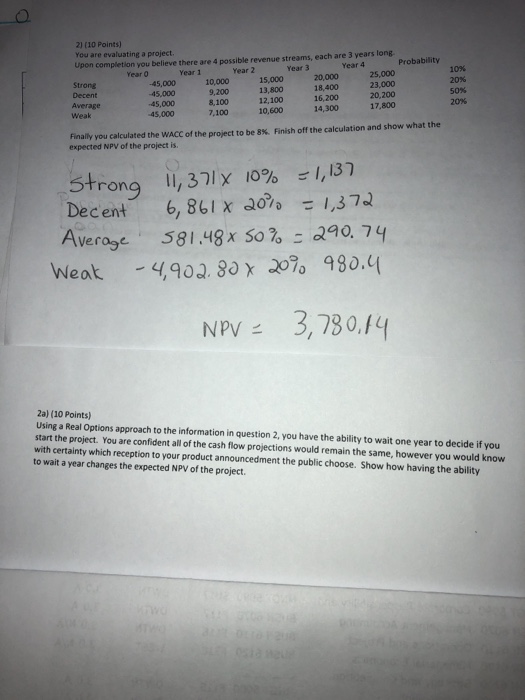

Question: 2) (10 Points) You are evaluating a project. Upon completion you believe there are 4 possible revenue streams, each are 3 years long Year 4

2) (10 Points) You are evaluating a project. Upon completion you believe there are 4 possible revenue streams, each are 3 years long Year 4 Probability vear 0 15,000 Year 1 Year 2 Year 3 25,000 23,000 20,200 17,800 10% 20% 50% 20% 20,000 18,400 Strong Decent Average Weak 45,00010010,600 45,000 45,000 15,000 9,2012,10014,300 13,800 8,100 7,100 16,200 10,600 Finally you calculated the WACC of the project to be 8%. Finish off the calculation and show what the expected NPV of the project is strong ll, 371x10% ??,137 Det 6,861 x ao, ,,374 Average, 581.48 xS0%?290,74 Weak -y90a. 80 ? 207, 980,q 30/ ec en NP 3,780,y 2a) (10 Points) Using a Real Options approach to the information in question 2, you have the ability to wait one year to decide if you start the project. You are confident all of the cash flow projections would remain the same, however you would know with certainty which reception to your product announcedment the public choose. Show how having the ability to wait a year changes the expected NPV of the project 2) (10 Points) You are evaluating a project. Upon completion you believe there are 4 possible revenue streams, each are 3 years long Year 4 Probability vear 0 15,000 Year 1 Year 2 Year 3 25,000 23,000 20,200 17,800 10% 20% 50% 20% 20,000 18,400 Strong Decent Average Weak 45,00010010,600 45,000 45,000 15,000 9,2012,10014,300 13,800 8,100 7,100 16,200 10,600 Finally you calculated the WACC of the project to be 8%. Finish off the calculation and show what the expected NPV of the project is strong ll, 371x10% ??,137 Det 6,861 x ao, ,,374 Average, 581.48 xS0%?290,74 Weak -y90a. 80 ? 207, 980,q 30/ ec en NP 3,780,y 2a) (10 Points) Using a Real Options approach to the information in question 2, you have the ability to wait one year to decide if you start the project. You are confident all of the cash flow projections would remain the same, however you would know with certainty which reception to your product announcedment the public choose. Show how having the ability to wait a year changes the expected NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts