Question: 2. (12) This question asks you to analyse the consequences of development and land taxes. Consider a builder using capital N and land l to

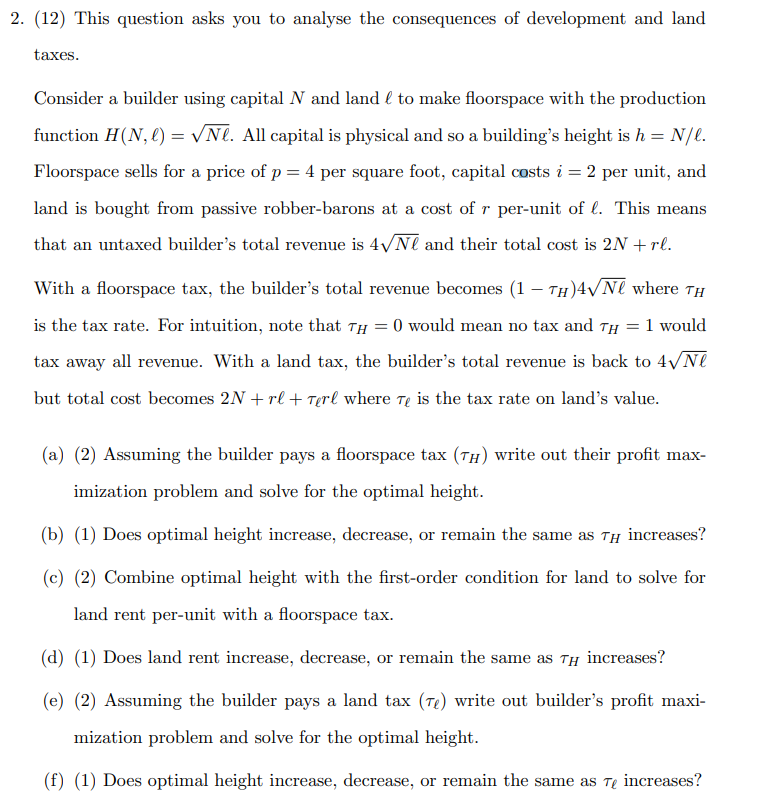

2. (12) This question asks you to analyse the consequences of development and land taxes. Consider a builder using capital N and land l to make floorspace with the production function H(N, 2) = VNC. All capital is physical and so a building's height is h = N/l. Floorspace sells for a price of p = 4 per square foot, capital costs i = 2 per unit, and land is bought from passive robber-barons at a cost of r per-unit of l. This means that an untaxed builder's total revenue is 4Nl and their total cost is 2N+rl. = With a floorspace tax, the builder's total revenue becomes (1 - Th4VNl where Th is the tax rate. For intuition, note that th = 0 would mean no tax and Th = 1 would tax away all revenue. With a land tax, the builder's total revenue is back to 4VNI but total cost becomes 2N+rl + terl where te is the tax rate on land's value. (a) (2) Assuming the builder pays a floorspace tax (Th) write out their profit max- imization problem and solve for the optimal height. (b) (1) Does optimal height increase, decrease, or remain the same as th increases? (c) (2) Combine optimal height with the first-order condition for land to solve for land rent per-unit with a floorspace tax. (d) (1) Does land rent increase, decrease, or remain the same as Th increases? (e) (2) Assuming the builder pays a land tax (Te) write out builder's profit maxi- mization problem and solve for the optimal height. (f) (1) Does optimal height increase, decrease, or remain the same as te increases? (g) (2) Combine optimal height with the first-order condition for land to solve for land rent per-unit with a land tax. (h) (1) Does land rent increase, decrease, or remain the same as te increases? (i) Bonus marks: land rent r will always be lower with a land tax than a property tax. This is true for any combination of th and te where each is between zero and one. Can you prove it? 2. (12) This question asks you to analyse the consequences of development and land taxes. Consider a builder using capital N and land l to make floorspace with the production function H(N, 2) = VNC. All capital is physical and so a building's height is h = N/l. Floorspace sells for a price of p = 4 per square foot, capital costs i = 2 per unit, and land is bought from passive robber-barons at a cost of r per-unit of l. This means that an untaxed builder's total revenue is 4Nl and their total cost is 2N+rl. = With a floorspace tax, the builder's total revenue becomes (1 - Th4VNl where Th is the tax rate. For intuition, note that th = 0 would mean no tax and Th = 1 would tax away all revenue. With a land tax, the builder's total revenue is back to 4VNI but total cost becomes 2N+rl + terl where te is the tax rate on land's value. (a) (2) Assuming the builder pays a floorspace tax (Th) write out their profit max- imization problem and solve for the optimal height. (b) (1) Does optimal height increase, decrease, or remain the same as th increases? (c) (2) Combine optimal height with the first-order condition for land to solve for land rent per-unit with a floorspace tax. (d) (1) Does land rent increase, decrease, or remain the same as Th increases? (e) (2) Assuming the builder pays a land tax (Te) write out builder's profit maxi- mization problem and solve for the optimal height. (f) (1) Does optimal height increase, decrease, or remain the same as te increases? (g) (2) Combine optimal height with the first-order condition for land to solve for land rent per-unit with a land tax. (h) (1) Does land rent increase, decrease, or remain the same as te increases? (i) Bonus marks: land rent r will always be lower with a land tax than a property tax. This is true for any combination of th and te where each is between zero and one. Can you prove it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts