Question: # 2. (13 points) Given that the risk free rate is 5% and the market portfolio has an expected return of 15% and a

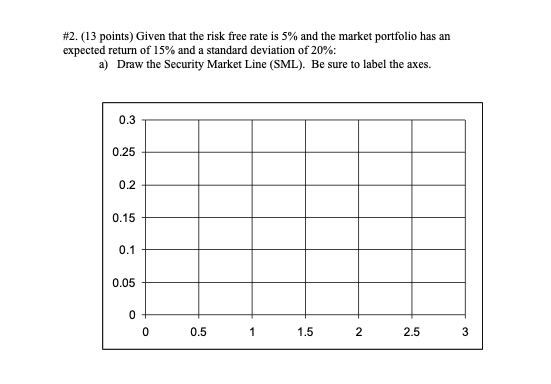

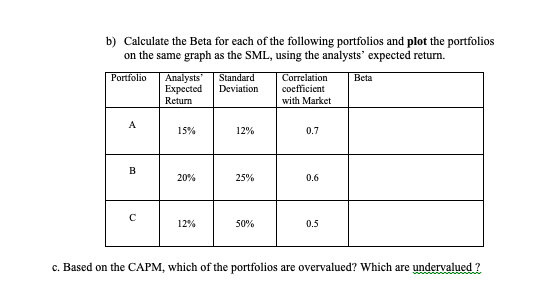

# 2. (13 points) Given that the risk free rate is 5% and the market portfolio has an expected return of 15% and a standard deviation of 20%: a) Draw the Security Market Line (SML). Be sure to label the axes. 0.3 0.25 0.2 0.15 0.1 0.05 0 0 0.5 1 1.5 2 2.5 3 b) Calculate the Beta for each of the following portfolios and plot the portfolios on the same graph as the SML, using the analysts' expected return. Standard Analysts' Expected Deviation Portfolio Return A 15% 12% Correlation Beta coefficient with Market 0.7 B 20% 25% 0.6 12% 50% 0.5 c. Based on the CAPM, which of the portfolios are overvalued? Which are undervalued?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts