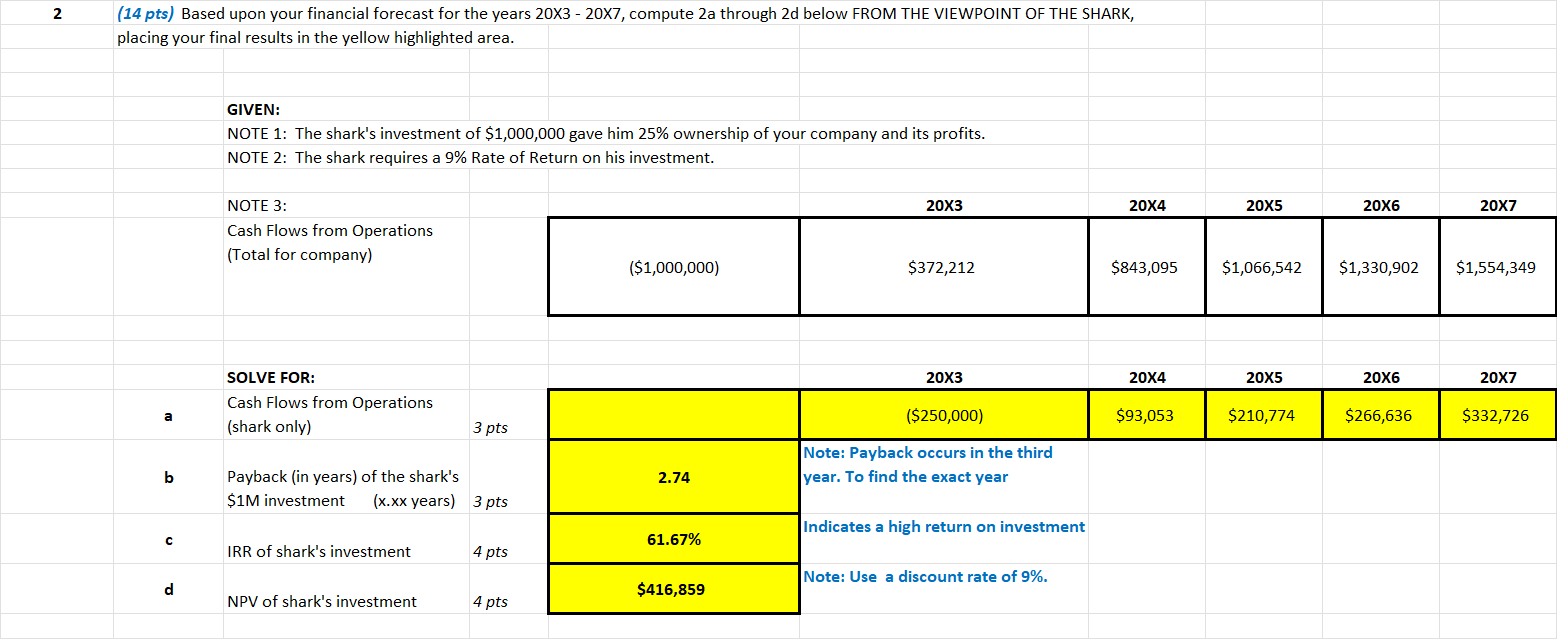

Question: 2 (14 pts) Based upon your financial forecast for the years 20X3 - 20X7, compute 2a through 2d below FROM THE VIEWPOINT OF THE SHARK,

"2 (14 pts) Based upon your financial forecast for the years 20X3 - 20X7, compute 2a through 2d below FROM THE VIEWPOINT OF THE SHARK, placing your final results in the yellow highlighted area. GIVEN: NOTE 1: The shark's investment of $1,000,000 gave him 25% ownership of your company and its profits. NOTE 2: The shark requires a 9% Rate of Return on his investment. NOTE 3: 20X3 20X4 20X5 20X6 20X7 Cash Flows from Operations (Total for company) ($1,000,000) $372,212 $843,095 $1,066,542 $1,330,902 $1,554,349 SOLVE FOR: 20X3 20X4 20X5 20X6 20X7 a Cash Flows from Operations (shark only) 3 pts ($250,000) $93,053 $210,774 $266,636 $332,726 b Payback (in years) of the shark's $1M investment (x.xx years) 3 pts 2.74 Note: Payback occurs in the third year. To find the exact year c IRR of shark's investment 4 pts 61.67% Indicates a high return on investment d NPV of shark's investment 4 pts $416,859 Note: Use a discount rate of 9%. " solve for the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts