Question: 2. (15 points) There are three stocks, A, B, and C, with the following expected return, volatility, and correlation data. You are asked to generate

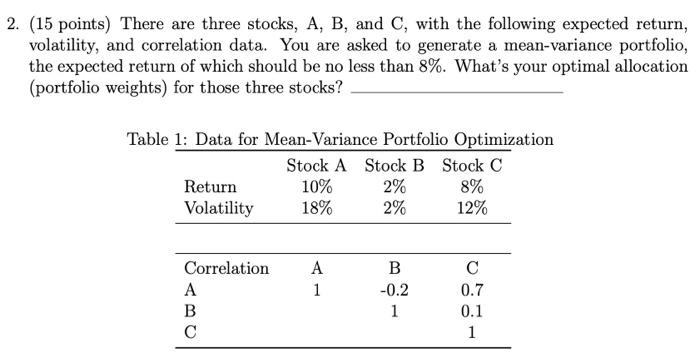

2. (15 points) There are three stocks, A, B, and C, with the following expected return, volatility, and correlation data. You are asked to generate a mean-variance portfolio, the expected return of which should be no less than 8%. What's your optimal allocation (portfolio weights) for those three stocks? Table 1: Data for Mean-Variance Portfolio Optimization Stock A Stock B Stock C 10% 2% 8% 18% 2% 12% Return Volatility Correlation A B C A 1 B -0.2 1 C 0.7 0.1 1

2. (15 points) There are three stocks, A, B, and C, with the following expected return, volatility, and correlation data. You are asked to generate a mean-variance portfolio, the expected return of which should be no less than \8. What's your optimal allocation (portfolio weights) for those three stocks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock