Question: (2.) 15 Points - You purchased one IBM bond eight years ago in the marketplace now. New bonds, similar in risk and quality to the

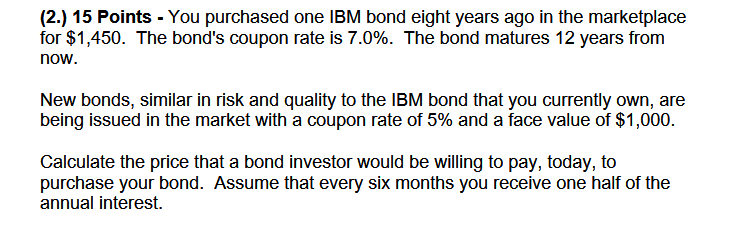

(2.) 15 Points - You purchased one IBM bond eight years ago in the marketplace now. New bonds, similar in risk and quality to the IBM bond that you currently own, are being issued in the market with a coupon rate of 5% and a face value of $1,000. Calculate the price that a bond investor would be willing to pay, today, to purchase your bond. Assume that every six months you receive one half of the annual interest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock