Question: 2 (15 pts) Alpha Semiconductor Co. is evaluating whether to add another IC production line. The line would cost $20000 and would have no market

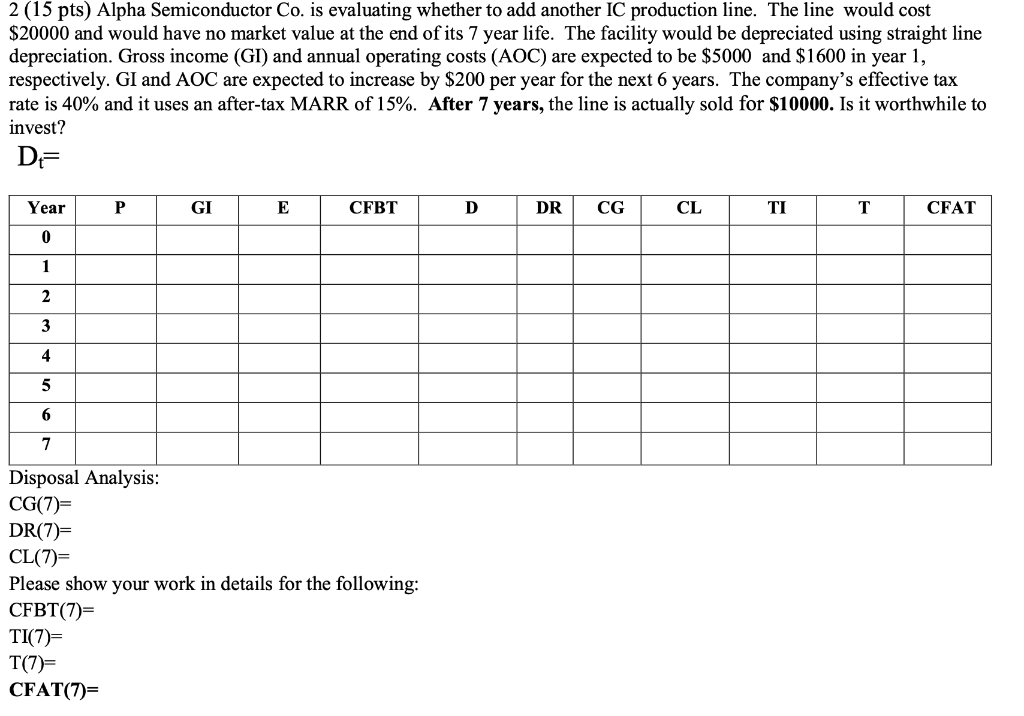

2 (15 pts) Alpha Semiconductor Co. is evaluating whether to add another IC production line. The line would cost $20000 and would have no market value at the end of its 7 year life. The facility would be depreciated using straight line depreciation. Gross income (GI) and annual operating costs (AOC) are expected to be $5000 and $1600 in year 1, respectively. GI and AOC are expected to increase by $200 per year for the next 6 years. The company's effective tax rate is 40% and it uses an after-tax MARR of 15%. After 7 years, the line is actually sold for $10000. Is it worthwhile to invest? D= Year P GI E CFBT D DR CG CL TI T CFAT 0 1 2 3 4 5 6 7 Disposal Analysis: CG(7)= DR(7) CL(7)= Please show your work in details for the following: CFBT(7)= TI(7)= T(7)= CFAT(7)= 2 (15 pts) Alpha Semiconductor Co. is evaluating whether to add another IC production line. The line would cost $20000 and would have no market value at the end of its 7 year life. The facility would be depreciated using straight line depreciation. Gross income (GI) and annual operating costs (AOC) are expected to be $5000 and $1600 in year 1, respectively. GI and AOC are expected to increase by $200 per year for the next 6 years. The company's effective tax rate is 40% and it uses an after-tax MARR of 15%. After 7 years, the line is actually sold for $10000. Is it worthwhile to invest? D= Year P GI E CFBT D DR CG CL TI T CFAT 0 1 2 3 4 5 6 7 Disposal Analysis: CG(7)= DR(7) CL(7)= Please show your work in details for the following: CFBT(7)= TI(7)= T(7)= CFAT(7)=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts