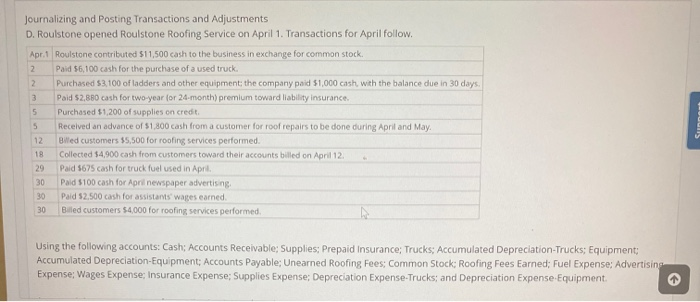

Question: 2 2 5 Journalizing and Posting Transactions and Adjustments D. Roulstone opened Roulstone Roofing Service on April 1. Transactions for April follow. Apr.1 Roulstone contributed

2 2 5 Journalizing and Posting Transactions and Adjustments D. Roulstone opened Roulstone Roofing Service on April 1. Transactions for April follow. Apr.1 Roulstone contributed $11,500 cash to the business in exchange for common stock. Paid $6,100 cash for the purchase of a used truck. Purchased $3,100 of ladders and other equipment, the company paid $1,000 cash, with the balance due in 30 days. Paid $2.880 cash for two-year for 24-month) premium toward liability insurance. Purchased $1,200 of supplies on credit. Received an advance of $1,800 cash from a customer for roof repairs to be done during April and May. 12 Biled customers 55,500 for roofing services performed. Collected $4,900 cash from customers toward their accounts billed on April 12 29 Paid 5675 cash for truck fuel used in April Paid $100 cash for April newspaper advertising 30 Pald 52,500 cash for assistants wages earned. Biled customers 54,000 for roofing services performed 5 uus 18 30 30 Using the following accounts: Cash; Accounts Receivable; Supplies; Prepaid insurance; Trucks: Accumulated Depreciation-Trucks; Equipment: Accumulated Depreciation-Equipment; Accounts Payable; Unearned Roofing Fees: Common Stock: Roofing Fees Earned; Fuel Expense; Advertising Expense; Wages Expense; Insurance Expense; Supplies Expense; Depreciation Expense Trucks; and Depreciation Expense Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts