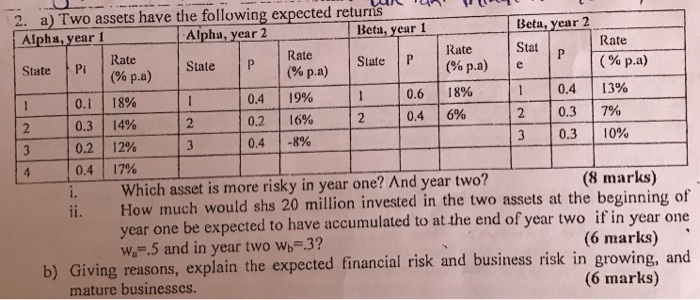

Question: 2 2. a) Two assets have the following expected returns un u z Alpha, year 1 Alpha, year 2 Beta, year 1 Beta, year 2

2 2. a) Two assets have the following expected returns un u z Alpha, year 1 Alpha, year 2 Beta, year 1 Beta, year 2 Rate Pi Rate Rate Stat Rate State IP State P (% p.a) (% p.a) State (% p.a) (% p.a) 0.1 18% 0.4 19% 0.6 18% 0.4 13% 0.3 14% 0.2 16% 0.4 6% 0.3 17% 0.2 12% 0.4 -8% 0.3 10% 0.4 17% Which asset is more risky in year one? And year two? (8 marks) How much would shs 20 million invested in the two assets at the beginning of year one be expected to have accumulated to at the end of year two if in year one W.-.5 and in year two W-.3? (6 marks) ' b) Giving reasons, explain the expected financial risk and business risk in growing, and mature businesses. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts