Question: 2 2 Assess the situation 2 Question 2 During 2 0 2 3 , Emily worked as a financial controller for Vector Industries ( VI

Assess the situation

Question

During Emily worked as a financial controller for Vector Industries VI and earned a salary of $ VI downsized its office space after the pandemic, and adopted a hybrid working policy whereby employees could work from home days a week. Given the smaller office footprint, it would not be possible for all VI employees to report to the office on the same day, so the hybrid arrangement is required to ensure that the building's fire code regulations are followed.

Emily worked from her home office days per week during Emily's home office is about of the total square footage of her home. Emily's role is not client facing, so she does not meet with clients of VI at her home.

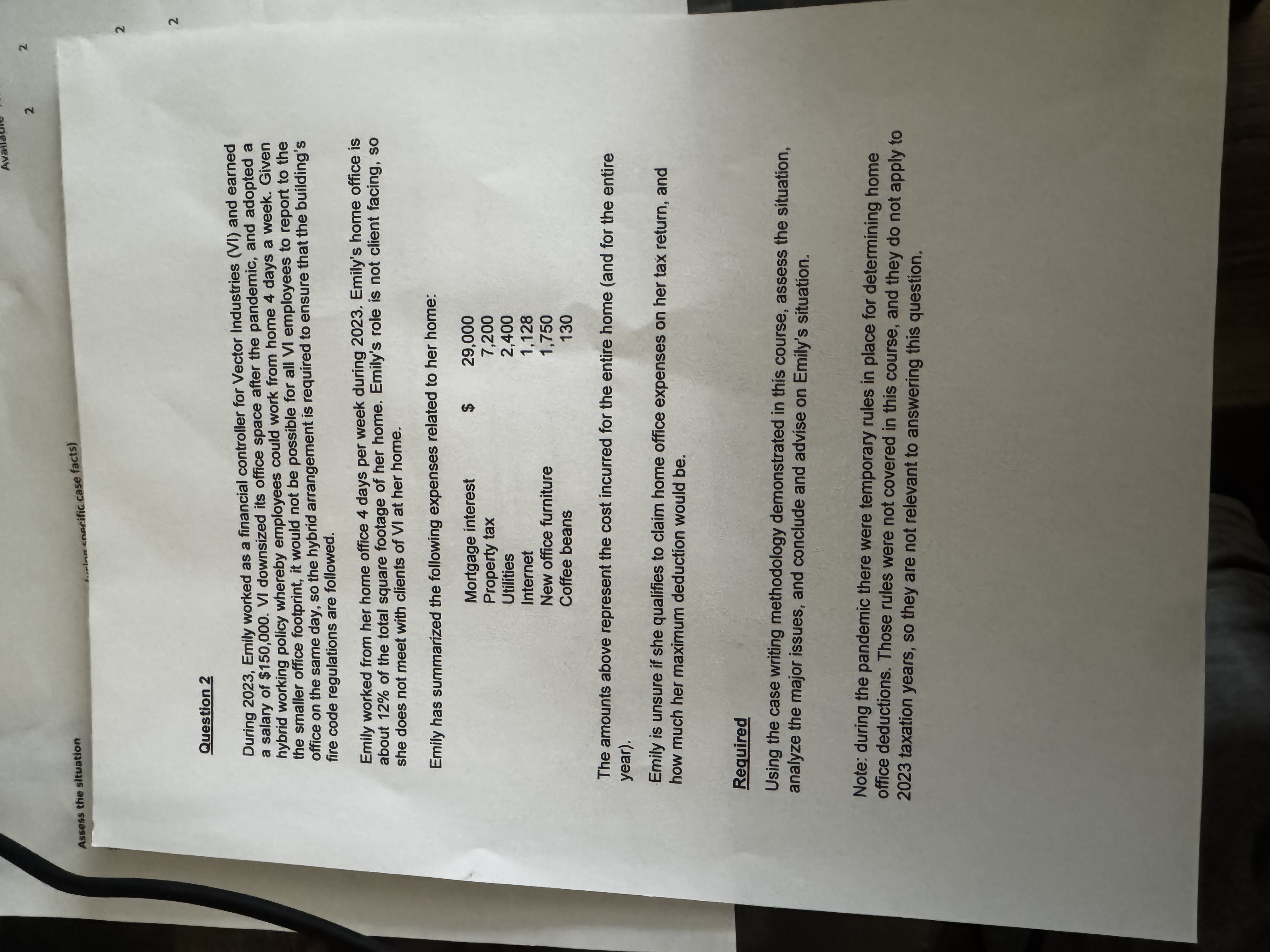

Emily has summarized the following expenses related to her home:

tableMortgage interest,$Property tax,UtilitiesInternetNew office furniture,,Coffee beans,

The amounts above represent the cost incurred for the entire home and for the entire year

Emily is unsure if she qualifies to claim home office expenses on her tax return, and how much her maximum deduction would be

Required

Using the case writing methodology demonstrated in this course, assess the situation, analyze the major issues, and conclude and advise on Emily's situation.

Note: during the pandemic there were temporary rules in place for determining home office deductions. Those rules were not covered in this course, and they do not apply to taxation years, so they are not relevant to answering this question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock