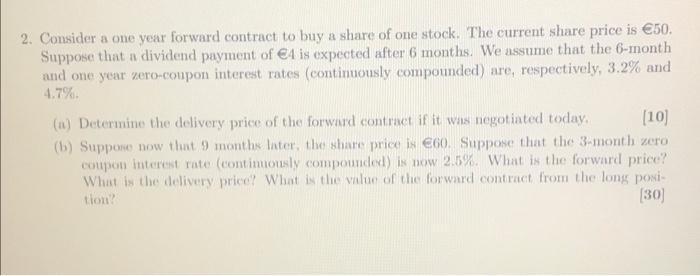

Question: 2 2. Consider a one year forward contract to buy a share of one stock. The current share price is 50. Suppose that a dividend

2 2. Consider a one year forward contract to buy a share of one stock. The current share price is 50. Suppose that a dividend payment of ex is expected after 6 months. We assume that the 6-month and one year vero-coupon interest rates (continuously compounded) are, respectively, 3.2% and 4.7% (1) Determine the delivery price of the forward contract if it was negotinted today, (10) (6) Suppose now that 9 months Inter, the share price is 60. Suppose that the month zero coupon interest rate (continuously compounded) is now 2.5%. What is the forward price? What in the delivery price? What is the value of the forward contract from the long poni tion? (30) 2 2. Consider a one year forward contract to buy a share of one stock. The current share price is 50. Suppose that a dividend payment of ex is expected after 6 months. We assume that the 6-month and one year vero-coupon interest rates (continuously compounded) are, respectively, 3.2% and 4.7% (1) Determine the delivery price of the forward contract if it was negotinted today, (10) (6) Suppose now that 9 months Inter, the share price is 60. Suppose that the month zero coupon interest rate (continuously compounded) is now 2.5%. What is the forward price? What in the delivery price? What is the value of the forward contract from the long poni tion? (30)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts