Question: 2. (20 marks) Under the binomial tree model, the European call option price is given by N C(0) =e --Nh ()'(1q)X-i (Sou'dN=1 K) (1 -

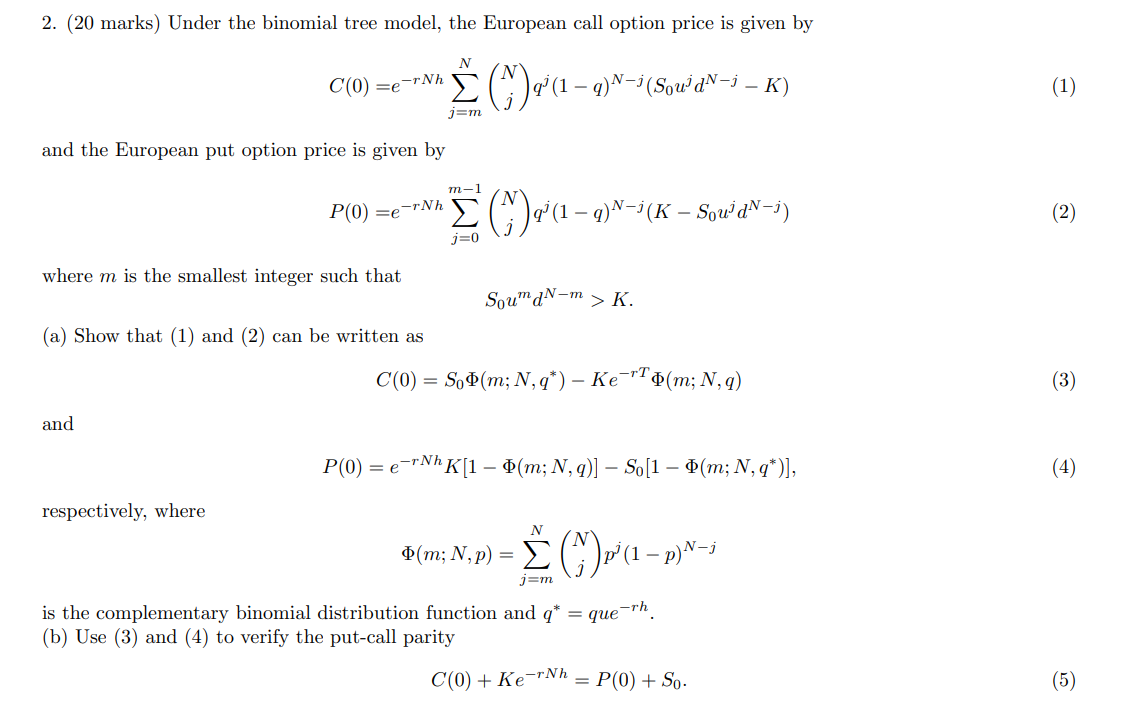

2. (20 marks) Under the binomial tree model, the European call option price is given by N C(0) =e --Nh ()'(1q)X-i (Sou'dN=1 K) (1 - (1) j=m and the European put option price is given by m-1 P(0) =e-rNh E ()q'(1 q)-i(K Sow? d =5) q1- (2) 2 j=0 where m is the smallest integer such that SoumdN-m > K. (a) Show that (1) and (2) can be written as C(0) = S,(m; N,q*) - Ke-rTo(m; N,q) (3) and P(0) = e-rNh K[1 $(m; N,q)] So[1 0(m; N,q*)], respectively, where N D(m; N,p) = ()pc p(1 p)N-; - j=m is the complementary binomial distribution function and q* = que-rh. (b) Use (3) and (4) to verify the put-call parity C(0) + Ke-rNh = P(0) + So. (5) 2. (20 marks) Under the binomial tree model, the European call option price is given by N C(0) =e --Nh ()'(1q)X-i (Sou'dN=1 K) (1 - (1) j=m and the European put option price is given by m-1 P(0) =e-rNh E ()q'(1 q)-i(K Sow? d =5) q1- (2) 2 j=0 where m is the smallest integer such that SoumdN-m > K. (a) Show that (1) and (2) can be written as C(0) = S,(m; N,q*) - Ke-rTo(m; N,q) (3) and P(0) = e-rNh K[1 $(m; N,q)] So[1 0(m; N,q*)], respectively, where N D(m; N,p) = ()pc p(1 p)N-; - j=m is the complementary binomial distribution function and q* = que-rh. (b) Use (3) and (4) to verify the put-call parity C(0) + Ke-rNh = P(0) + So

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts