Question: 2 (20 points) Forwards A stock trades at So = $50. It pays a continuous annualized dividend rate of 2%. The continuously compounded risk-free rate

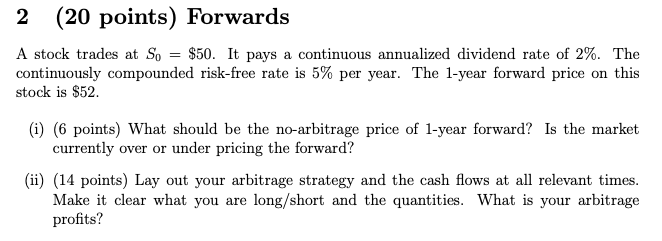

2 (20 points) Forwards A stock trades at So = $50. It pays a continuous annualized dividend rate of 2%. The continuously compounded risk-free rate is 5% per year. The 1-year forward price on this stock is $52. (i) (6 points) What should be the no-arbitrage price of 1-year forward? Is the market currently over or under pricing the forward? (ii) (14 points) Lay out your arbitrage strategy and the cash flows at all relevant times. Make it clear what you are long/short and the quantities. What is your arbitrage profits? 2 (20 points) Forwards A stock trades at So = $50. It pays a continuous annualized dividend rate of 2%. The continuously compounded risk-free rate is 5% per year. The 1-year forward price on this stock is $52. (i) (6 points) What should be the no-arbitrage price of 1-year forward? Is the market currently over or under pricing the forward? (ii) (14 points) Lay out your arbitrage strategy and the cash flows at all relevant times. Make it clear what you are long/short and the quantities. What is your arbitrage profits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts