Question: 2. 2.1 Consider the binomial model with u = 1.25, d = 0.8, risk-free rate of 10% and initial asset price So = 100. Calculate

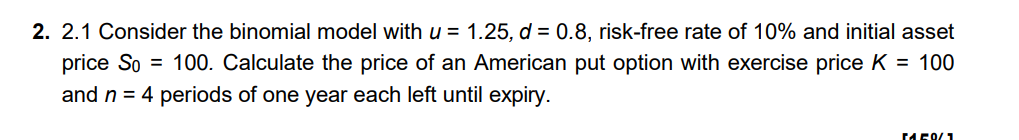

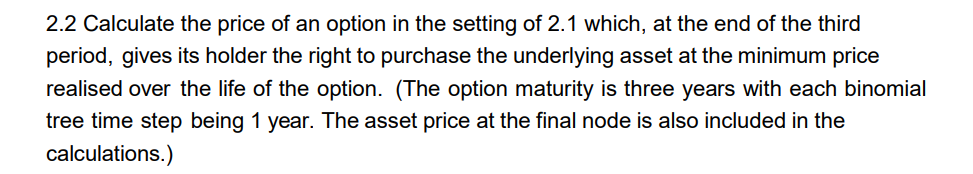

2. 2.1 Consider the binomial model with u = 1.25, d = 0.8, risk-free rate of 10% and initial asset price So = 100. Calculate the price of an American put option with exercise price K = 100 and n = 4 periods of one year each left until expiry. TA 50/1 2.2 Calculate the price of an option in the setting of 2.1 which, at the end of the third period, gives its holder the right to purchase the underlying asset at the minimum price realised over the life of the option. (The option maturity is three years with each binomial tree time step being 1 year. The asset price at the final node is also included in the calculations.) 2. 2.1 Consider the binomial model with u = 1.25, d = 0.8, risk-free rate of 10% and initial asset price So = 100. Calculate the price of an American put option with exercise price K = 100 and n = 4 periods of one year each left until expiry. TA 50/1 2.2 Calculate the price of an option in the setting of 2.1 which, at the end of the third period, gives its holder the right to purchase the underlying asset at the minimum price realised over the life of the option. (The option maturity is three years with each binomial tree time step being 1 year. The asset price at the final node is also included in the calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts