Question: 2. (21%) the 2-year project. The equipment falls into the MACRS 3-year class, and will be sold after You are assigned to evaluate proposed acquisition

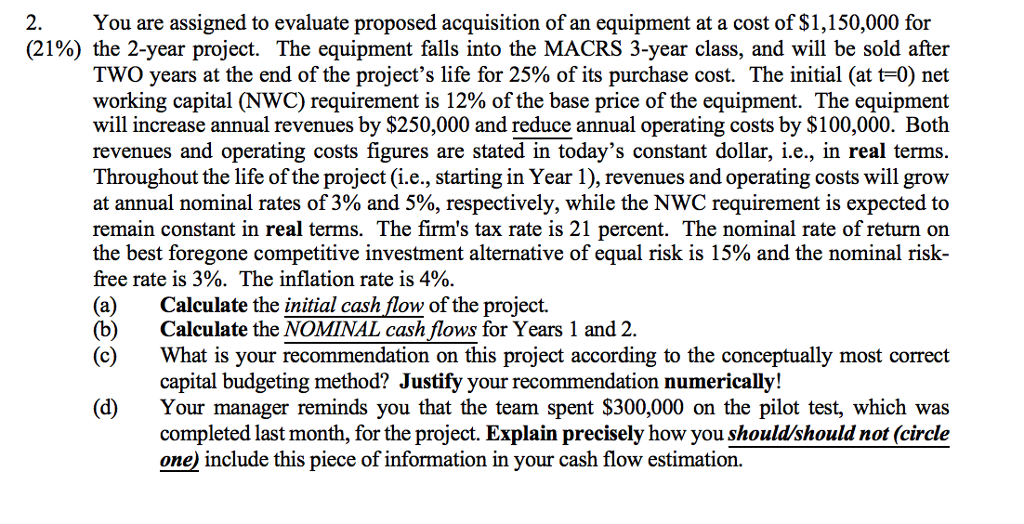

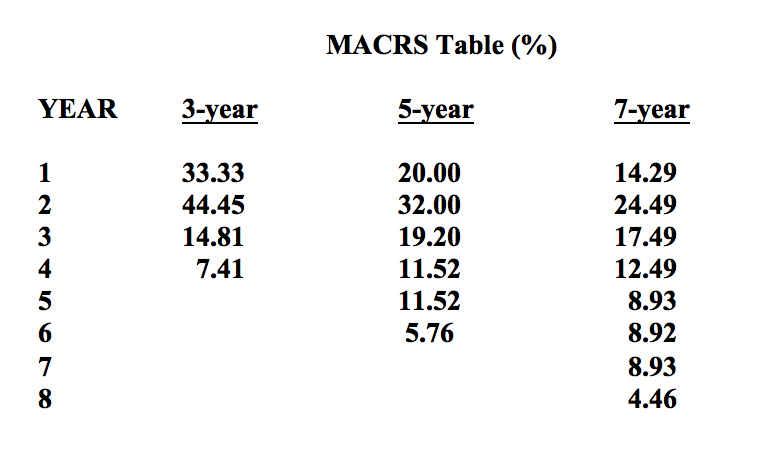

2. (21%) the 2-year project. The equipment falls into the MACRS 3-year class, and will be sold after You are assigned to evaluate proposed acquisition of an equipment at a cost of S1,150,000 for Two years at the end of the project's life for 25% of its purchase cost. The initial (at t-0) net working capital (NWC) requirement is 12% of the base price of the equipment. The equipment will increase annual revenues by $250,000 and reduce annual operating costs by $100,000. Both revenues and operating costs figures are stated in today's constant dollar, i.e., in real terms Throughout the life of the project (i.e., starting in Year 1), revenues and operating costs will grow at annual nominal rates of 3% and 5%, respectively, while the NWC requirement is expected to remain constant in real terms. The firm's tax rate is 21 percent. The nominal rate of return on the best foregone competitive investment alternative of equal risk is 15% and the nominal risk- free rate is 3%. The inflation rate is 4%. (a) Calculate the initial cash flow of the project. (b)Calculate the NOMINAL cash flows for Years 1 and 2. (c)What is your recommendation on this project according to the conceptually most correct capital budgeting method? Justify your recommendation numerically! (d)Your manager reminds you that the team spent $300,000 on the pilot test, which was completed last month, for the project. Explain precisely how you shouldshould not (circle one) include this piece of information in vour cash flow estimation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts