Question: 2. (24 points) Skymoon is considering a new project. The project will require a purchase of equipment with the purchase price of $90,000. Shipping and

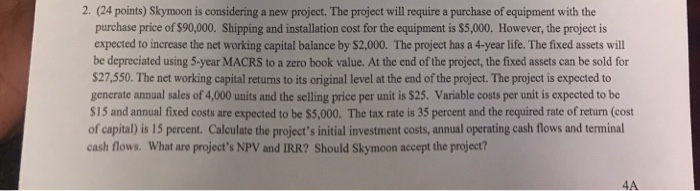

2. (24 points) Skymoon is considering a new project. The project will require a purchase of equipment with the purchase price of $90,000. Shipping and installation cost for the equipment is $5,000. However, the project is expected to increase the net working capital balance by $2,000. The project has a 4-year life. The fixed assets will be depreciated using 5-year MACRS to a zero book value. At the end of the project, the fixed assets can be sold for $27,550. The net working capital returns to its original level at the end of the project. The project is expected to generate annual sales of 4,000 units and the selling price per unit is $25. Variable costs per unit is expected to be $15 and annual fixed costs are expected to be $5,000. The tax rate is 35 percent and the required rate of return (cost of capital) is 15 percent. Calculate the project's initial investment costs, annual operating cash flows and terminal cash flows. What are project's NPV and IRR? Should Skymoon accept the project? 4A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts