Question: 2. (25 points) Stapleton Manufacturing Co plans to undertake one of the following two projects, say A and B. for this fiscal year. The cost

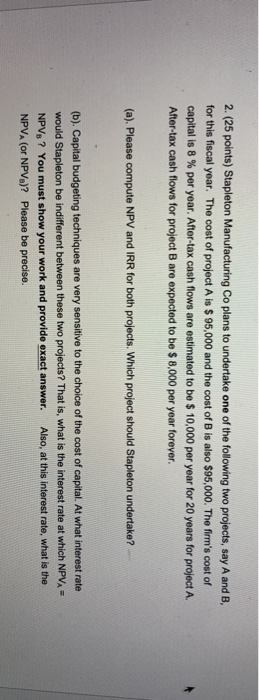

2. (25 points) Stapleton Manufacturing Co plans to undertake one of the following two projects, say A and B. for this fiscal year. The cost of project A is $ 95,000 and the cost of B is also $95,000. The firm's cost of capital is 8 % per year. After-tax cash flows are estimated to be $10,000 per year for 20 years for project A. After-tax cash flows for project B are expected to be $ 8,000 per year forever, (a). Please compute NPV and IRR for both projects. Which project should Stapleton undertake? (b). Capital budgeting techniques are very sensitive to the choice of the cost of capital. At what interest rate would Stapleton be indifferent between these two projects? That is what is the interest rate at which NPVA NPV,? You must show your work and provide exact answer. Also, at this interest rate, what is the NPVA (or NPV)? Please be precise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts