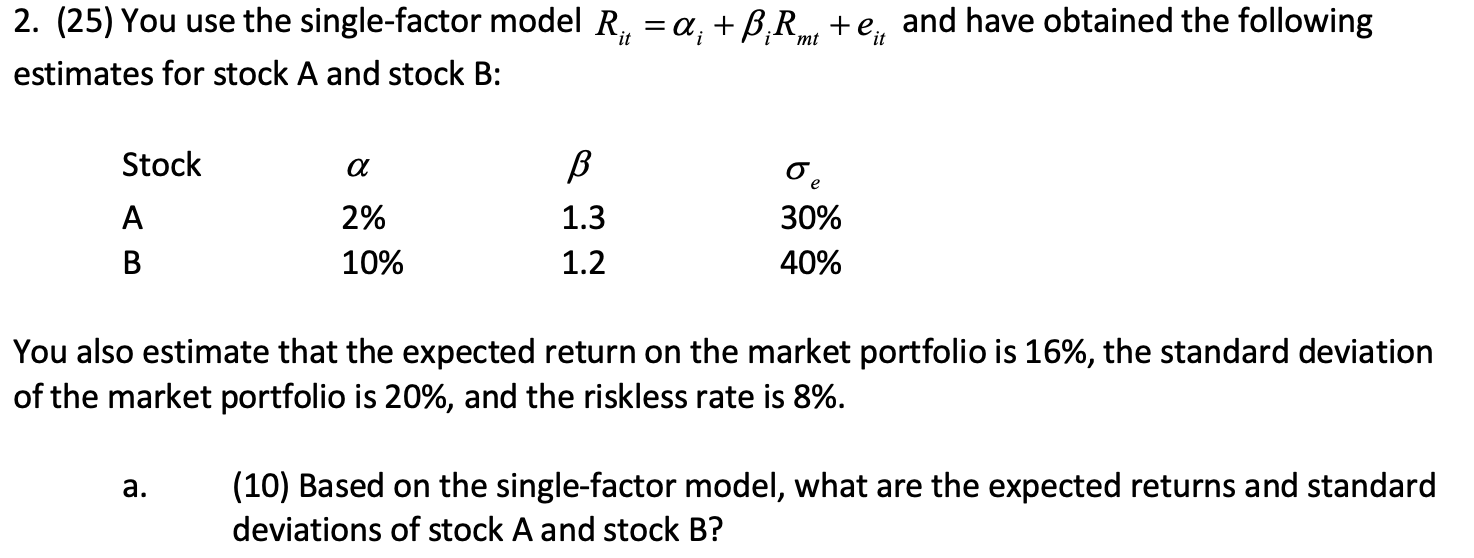

Question: 2. (25) You use the single-factor model R;, = 0; + B,R Me +e; and have obtained the following estimates for stock A and stock

2. (25) You use the single-factor model R;, = 0; + B,R Me +e; and have obtained the following estimates for stock A and stock B: a be Stock A B 2% 10% B 1.3 1.2 30% 40% You also estimate that the expected return on the market portfolio is 16%, the standard deviation of the market portfolio is 20%, and the riskless rate is 8%. a. (10) Based on the single-factor model, what are the expected returns and standard deviations of stock A and stock B? b . (15) For each of: (i) the single-factor model, (ii) the Security Market Line, and (iii) the Capital Market Line, Compute the expected returns and state whether each of the following statements is completely true, completely false, or uncertain. Explain your answers. 1) 2) 3) 4) In any given year, stock B is certain to outperform stock A. An investor would consider stock B to be riskier than stock A. Stock A is undervalued. If an investor had to select one investment to combine with the riskless asset, the investor would prefer stock A to the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts