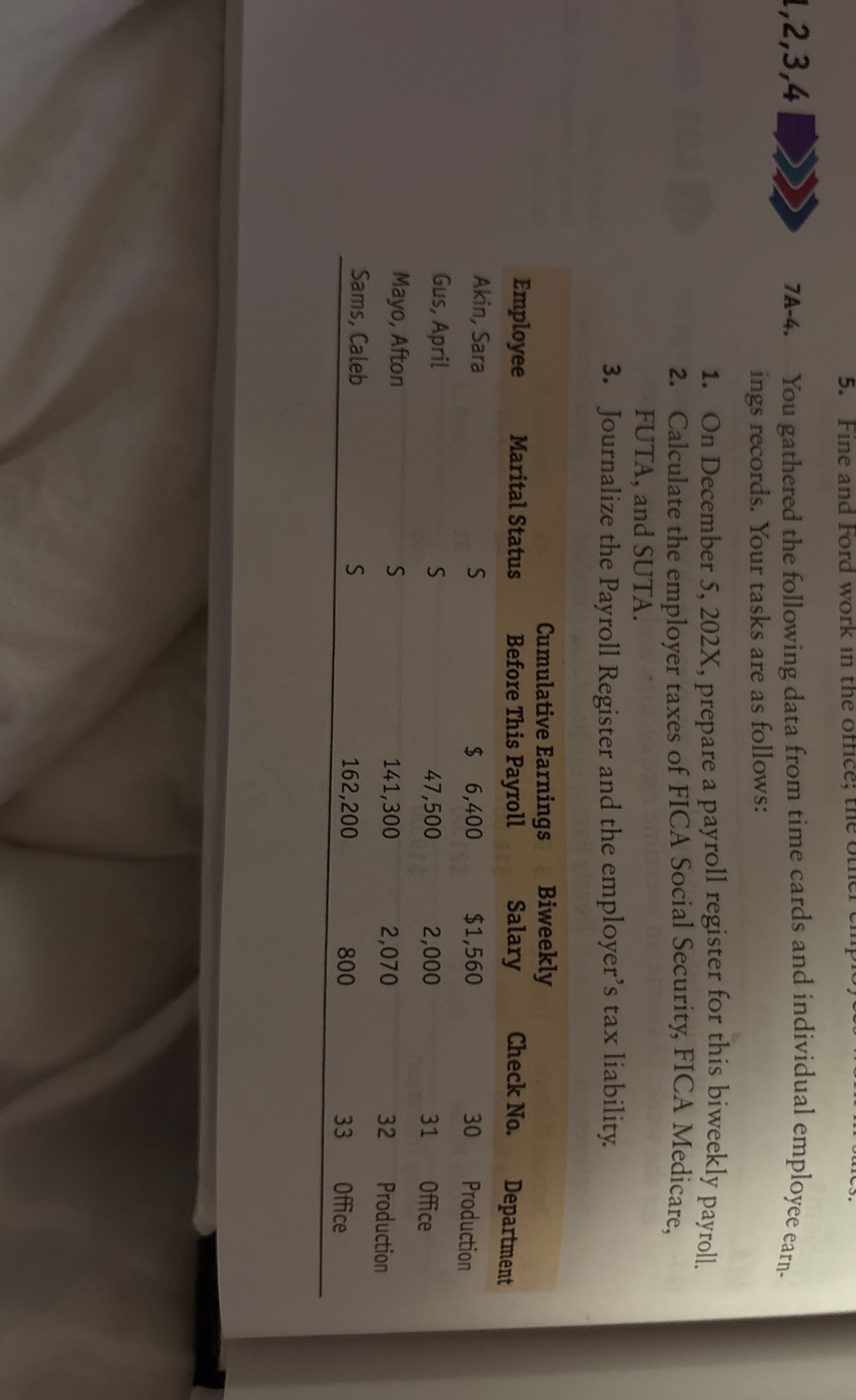

Question: , 2 , 3 , 4 ( > > > 7 A - 4 . You gathered the following data from time cards and individual

A You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows:

On December prepare a payroll register for this biweekly payroll.

Calculate the employer taxes of FICA Social Security, FICA Medicare, FUTA, and SUTA.

Journalize the Payroll Register and the employer's tax liability.

tableEmployeeMarital Status,tableCumulative EarningsBefore This PayrolltableBiweeklySalaryCheck NoDepartmentAkin Sara,S$$ProductionGus April,SOfficeMayo Afton,SProductionSams Caleb,SOfficeCHAPTER Calculating Pay and Recording Payroll Taxes: The Beginning o

Assume the following:

FICA Social Security is on $; FICA Medicare is on all earnings.

Federal income tax is calculated from Figure

State income tax is of gross pay.

Charitable Contributions are $ biweekly.

The SUTA rate is and the FUTA rate is on earnings up to $

Set B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock