Question: 2, 3, 4, 5 ASSN 12 Ch 06: Assignment - Interest Rates 2. The market for capital Firms require capital to invest in productive opportunities.

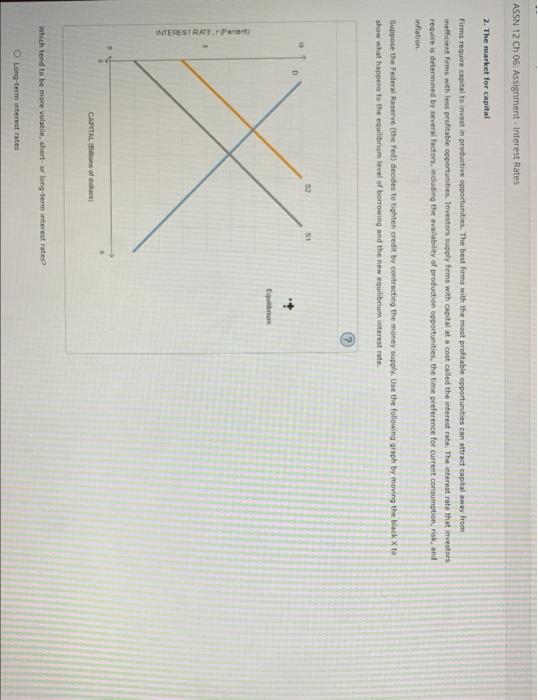

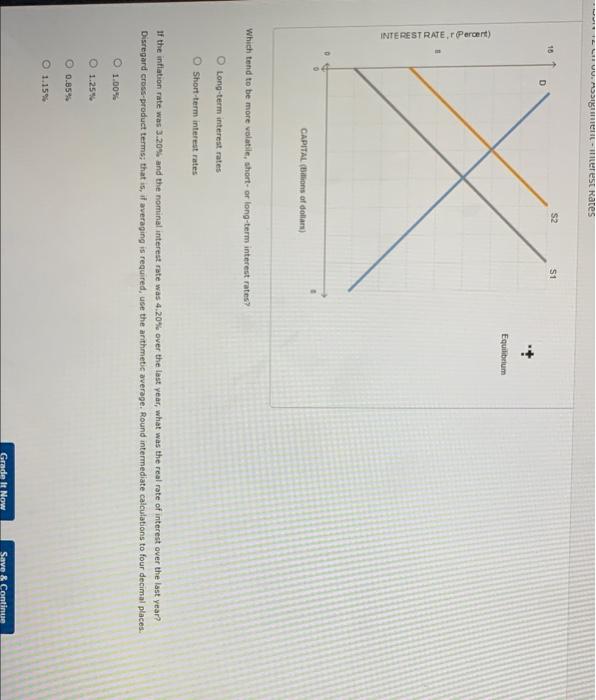

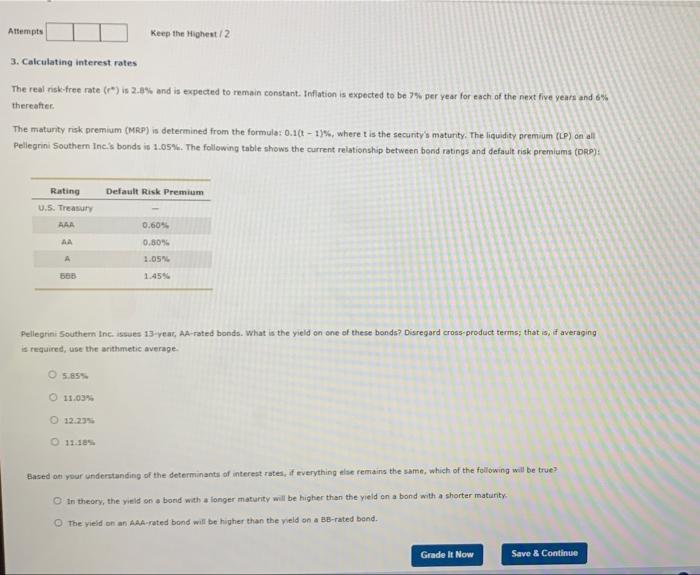

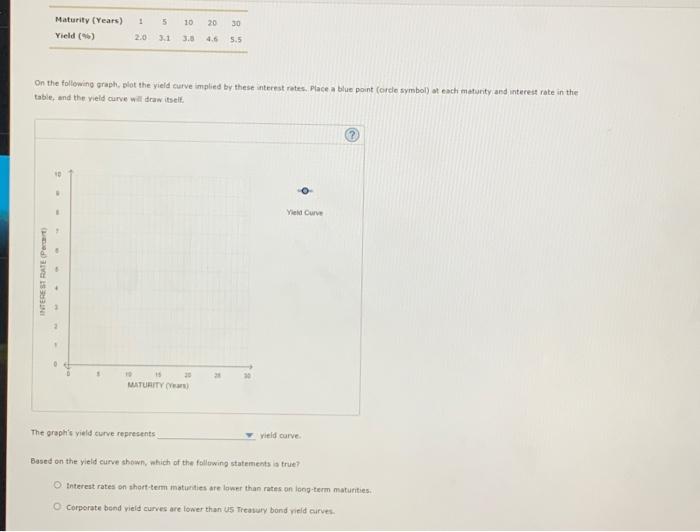

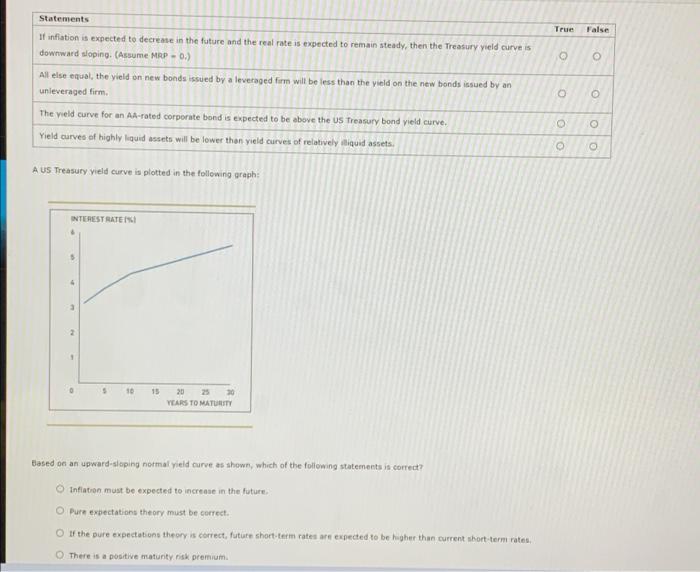

ASSN 12 Ch 06: Assignment - Interest Rates 2. The market for capital Firms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost called the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk and ination Suppose the Federal Reserve the Fed} decides to tighten credit by contracting the money supply. Use the following uraph by moving the black to show what happens to the mouilibrium level of borrowing and the new equilibrium interest rate. + Equm INTERESTRE) CAPITAL Bilions of Which tend to be more volatile, short- or long-term interest rates? O Long-term interest rates wer. Terest Rates 18 S2 S1 D Equilibrium INTEREST RATE,Percent) CAPITAL (Bons of dollars) Which tend to be more volatile, short or long-term interest rates? O Long-term interest rates Short-term interest rates If the inflation rate was 3.20% and the nominal interest rate was 4.20% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, it averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. O 1.00 1.25 0.85% 1.15% Grade It Now Save & Continue Attempts Keep the Highest 2 3. Calculating interest rates The real risk-free rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be 7% per year for each of the next five years and 6% thereafter The maturity risk premium (MRP) is determined from the formula: 0.10 - 1)%, where t is the security's maturity. The liquidity premium (LP) an all Pellegrini Southern Ine's bonds is 1.05%. The following table shows the current relationship between bond ratings and default risk premiums (DAP) Default Risk Premium Rating 1.5. Treasury AAA AA 0.60% 0,80% 1.05 555 1.455 Pellegrini Southern Inc. issues 15-ven, Aarated bonds. What is the yield on one of these bonda? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average 5.555 11.03% 12.23 11.18 Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true In theory, the yield on bond with a longer maturity will be higher than the yield on a bond with a shorter maturity The yield on an AA rated bond will be higher than the yield on a BB-rated band. Grade it Now Save & Continue 1 5 10 30 Maturity (Years) Yield (*) 20 4.6 2.0 3.1 JO 5.5 On the following graph, plot the yield curve impled by these interest rates, Place a blue point (orde symbol) at each maturity and interest rate in the table, and the yield curve will draw itselt . Yield Curve INTEREST RATE ( Part . MATURITY The graphi's vield Curve represents yield curve Based on the yield curve shown which of the following statements is true? Interest rates on short-term maturities are lower than rates on long-term matunities Corporate bond yield curves are lower than US Treasury bond yield Curves SN 12 Ch 06: Assignment - Interest Rates ack to Assignment Attempts Keep the Highest / 3 5. Factors that impact the yield curve There are three factors that can affect the shape of the Treasury yield curve (r, IP, and MRP) and five factors that can affect the shape of the corporate yield curve (r, IPE, MRPE, DRP, and LP). The yield curve reflects the aggregation of the impacts from these factors Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identity which of the following shapes that the US Treasury yield curve can take. Check all that apply. Upward-sloping yield curve Inverted yield curve Downward sloping yield curve Identify whether each of the following statements is true or false True False O Statements If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP -0.) All else egual, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The yield curve for an AA-rated corporate bond is expected to be above the US Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets, O 0 A US Treasury vield curve is plotted in the following graphi INTEREST RATES 5 Statements True False If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curveis downward sloping. Assume MRP -0.) O o All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The Vield curve for an AA rated corporate bond is expected to be above the US Treasury bond yield curve. Yield curves of highly liquid essets will be lower than yield curves of relatively liquid assets. A US Treasury yield curve is plotted in the following graph: INTEREST RATES . 5 3 2 1 5 10 15 20 30 YEARS TO MATURITY Based on an upward sloping normal yield curve as shown, which of the following statements is correct Inflation must be expected to increase in the future, O Pure expectations theory must be correct. If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates, There is a positive naturty risk premium ASSN 12 Ch 06: Assignment - Interest Rates 2. The market for capital Firms require capital to invest in productive opportunities. The best firms with the most profitable opportunities can attract capital away from inefficient firms with less profitable opportunities. Investors supply firms with capital at a cost called the interest rate. The interest rate that investors require is determined by several factors, including the availability of production opportunities, the time preference for current consumption, risk and ination Suppose the Federal Reserve the Fed} decides to tighten credit by contracting the money supply. Use the following uraph by moving the black to show what happens to the mouilibrium level of borrowing and the new equilibrium interest rate. + Equm INTERESTRE) CAPITAL Bilions of Which tend to be more volatile, short- or long-term interest rates? O Long-term interest rates wer. Terest Rates 18 S2 S1 D Equilibrium INTEREST RATE,Percent) CAPITAL (Bons of dollars) Which tend to be more volatile, short or long-term interest rates? O Long-term interest rates Short-term interest rates If the inflation rate was 3.20% and the nominal interest rate was 4.20% over the last year, what was the real rate of interest over the last year? Disregard cross-product terms; that is, it averaging is required, use the arithmetic average. Round intermediate calculations to four decimal places. O 1.00 1.25 0.85% 1.15% Grade It Now Save & Continue Attempts Keep the Highest 2 3. Calculating interest rates The real risk-free rate (r) is 2.8% and is expected to remain constant. Inflation is expected to be 7% per year for each of the next five years and 6% thereafter The maturity risk premium (MRP) is determined from the formula: 0.10 - 1)%, where t is the security's maturity. The liquidity premium (LP) an all Pellegrini Southern Ine's bonds is 1.05%. The following table shows the current relationship between bond ratings and default risk premiums (DAP) Default Risk Premium Rating 1.5. Treasury AAA AA 0.60% 0,80% 1.05 555 1.455 Pellegrini Southern Inc. issues 15-ven, Aarated bonds. What is the yield on one of these bonda? Disregard cross-product terms; that is, if averaging is required, use the arithmetic average 5.555 11.03% 12.23 11.18 Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true In theory, the yield on bond with a longer maturity will be higher than the yield on a bond with a shorter maturity The yield on an AA rated bond will be higher than the yield on a BB-rated band. Grade it Now Save & Continue 1 5 10 30 Maturity (Years) Yield (*) 20 4.6 2.0 3.1 JO 5.5 On the following graph, plot the yield curve impled by these interest rates, Place a blue point (orde symbol) at each maturity and interest rate in the table, and the yield curve will draw itselt . Yield Curve INTEREST RATE ( Part . MATURITY The graphi's vield Curve represents yield curve Based on the yield curve shown which of the following statements is true? Interest rates on short-term maturities are lower than rates on long-term matunities Corporate bond yield curves are lower than US Treasury bond yield Curves SN 12 Ch 06: Assignment - Interest Rates ack to Assignment Attempts Keep the Highest / 3 5. Factors that impact the yield curve There are three factors that can affect the shape of the Treasury yield curve (r, IP, and MRP) and five factors that can affect the shape of the corporate yield curve (r, IPE, MRPE, DRP, and LP). The yield curve reflects the aggregation of the impacts from these factors Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. Consider all factors that affect the yield curve. Then identity which of the following shapes that the US Treasury yield curve can take. Check all that apply. Upward-sloping yield curve Inverted yield curve Downward sloping yield curve Identify whether each of the following statements is true or false True False O Statements If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curve is downward sloping. (Assume MRP -0.) All else egual, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The yield curve for an AA-rated corporate bond is expected to be above the US Treasury bond yield curve. Yield curves of highly liquid assets will be lower than yield curves of relatively illiquid assets, O 0 A US Treasury vield curve is plotted in the following graphi INTEREST RATES 5 Statements True False If inflation is expected to decrease in the future and the real rate is expected to remain steady, then the Treasury yield curveis downward sloping. Assume MRP -0.) O o All else equal, the yield on new bonds issued by a leveraged firm will be less than the yield on the new bonds issued by an unleveraged firm. The Vield curve for an AA rated corporate bond is expected to be above the US Treasury bond yield curve. Yield curves of highly liquid essets will be lower than yield curves of relatively liquid assets. A US Treasury yield curve is plotted in the following graph: INTEREST RATES . 5 3 2 1 5 10 15 20 30 YEARS TO MATURITY Based on an upward sloping normal yield curve as shown, which of the following statements is correct Inflation must be expected to increase in the future, O Pure expectations theory must be correct. If the pure expectations theory is correct, future short-term rates are expected to be higher than current short-term rates, There is a positive naturty risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts