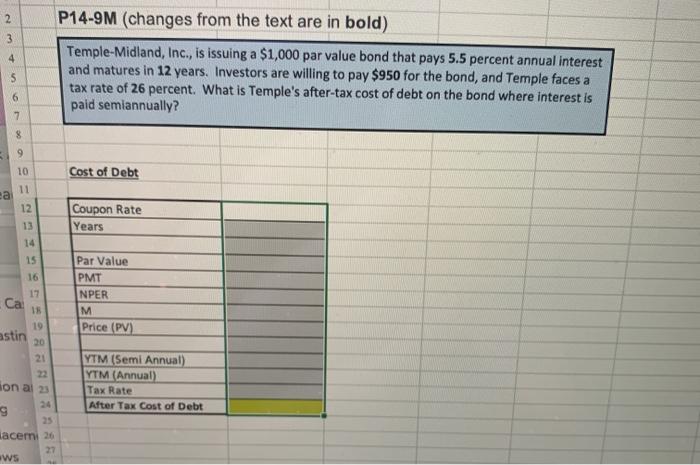

Question: 2 3 4 P14-9M (changes from the text are in bold) Temple-Midland, Inc., is issuing a $1,000 par value bond that pays 5.5 percent annual

2 3 4 P14-9M (changes from the text are in bold) Temple-Midland, Inc., is issuing a $1,000 par value bond that pays 5.5 percent annual interest and matures in 12 years. Investors are willing to pay $950 for the bond, and Temple faces a tax rate of 26 percent. What is Temple's after-tax cost of debt on the bond where interest is paid semiannually? 5 6 7 8 9 10 Cost of Debt 11 sa 12 13 Coupon Rate Years 15 16 17 Ca 15 19 astin 20 21 Par Value PMT NPER M Price (PV) ional 2 YTM (Semi Annual) YTM Annual) Tax Rate After Tax Cost of Debt lacemi 26 ws

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts