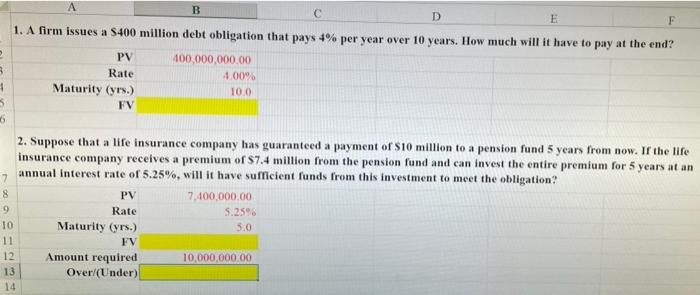

Question: 2 3 + 5 6 B D E F 1. A firm issues a $400 million debt obligation that pays 4% per year over 10

2 3 + 5 6 B D E F 1. A firm issues a $400 million debt obligation that pays 4% per year over 10 years. How much will it have to pay at the end? PV 400,000,000.00 Rate 1.00% Maturity (yrs.) 10.0 FV 2. Suppose that a life insurance company has guaranteed a payment of S10 million to a pension fund 5 years from now. If the life insurance company receives a premium of $7.4 million from the pension fund and can invest the entire premium for 5 years at an 7 annual interest rate of 5.25%, will it have sufficient funds from this investment to meet the obligation 8 PV 7.400,000.00 9 Rate 5.2596 10 Maturity (yrs.) 5.0 11 12 Amount required 10,000,000.00 13 Over/(Under) 14 FV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts