Question: 2. 3. Answer all correctly for a thumbs up! You have just turned 22 years old, received your bachelor's degree, and accepted your first job.

2.

2.

3.

3.

Answer all correctly for a thumbs up!

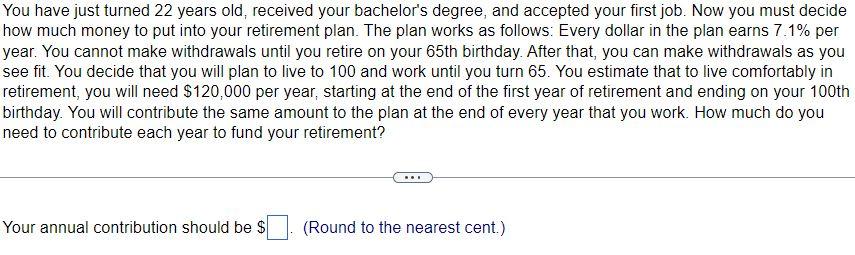

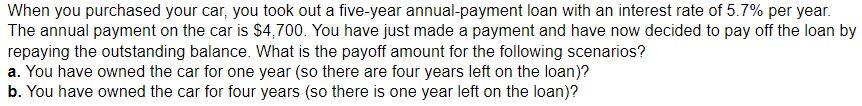

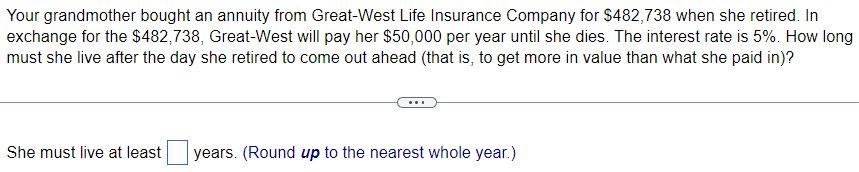

You have just turned 22 years old, received your bachelor's degree, and accepted your first job. Now you must decide how much money to put into your retirement plan. The plan works as follows: Every dollar in the plan earns 7.1% per year. You cannot make withdrawals until you retire on your 65 th birthday. After that, you can make withdrawals as you see fit. You decide that you will plan to live to 100 and work until you turn 65 . You estimate that to live comfortably in retirement, you will need $120,000 per year, starting at the end of the first year of retirement and ending on your 100th birthday. You will contribute the same amount to the plan at the end of every year that you work. How much do you need to contribute each year to fund your retirement? Your annual contribution should be \$ (Round to the nearest cent.) When you purchased your car, you took out a five-year annual-payment loan with an interest rate of 5.7% per year. The annual payment on the car is $4,700. You have just made a payment and have now decided to pay off the loan by repaying the outstanding balance. What is the payoff amount for the following scenarios? a. You have owned the car for one year (so there are four years left on the loan)? b. You have owned the car for four years (so there is one year left on the loan)? Your grandmother bought an annuity from Great-West Life Insurance Company for $482,738 when she retired. In exchange for the $482,738, Great-West will pay her $50,000 per year until she dies. The interest rate is 5%. How long must she live after the day she retired to come out ahead (that is, to get more in value than what she paid in)? She must live at least years. (Round up to the nearest whole year.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts