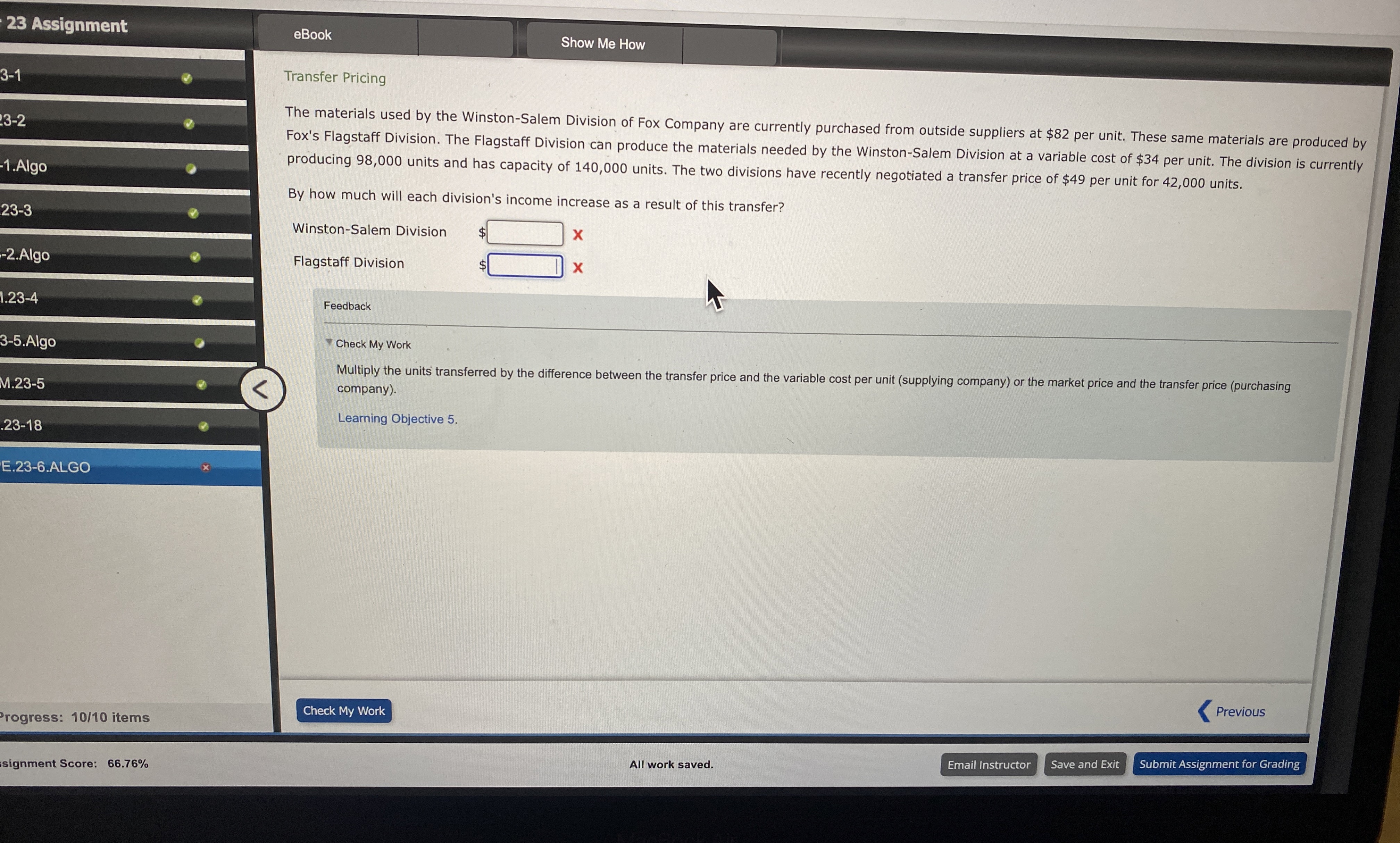

Question: 2 3 Assignment eBook Show Me How Transfer Pricing The materials used by the Winston - Salem Division of Fox Company are currently purchased from

Assignment

eBook

Show Me How

Transfer Pricing

The materials used by the WinstonSalem Division of Fox Company are currently purchased from outside suppliers at $ per unit. These same materials are produced by Fox's Flagstaff Division. The Flagstaff Division can produce the materials needed by the WinstonSalem Division at a variable cost of $ per unit. The division is currently producing units and has capacity of units. The two divisions have recently negotiated a transfer price of $ per unit for units.

By how much will each division's income increase as a result of this transfer?

WinstonSalem Division

$

Flagstaff Division

$

Feedback

Check My Work

Multiply the units transferred by the difference between the transfer price and the variable cost per unit supplying company or the market price and the transfer price purchasing company

Learning Objective

rogress: items

Previous

Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock