Question: 2 3 Due Date: 23:59 PM - 22 April 2022 Type: Individual Group Werk Assignment Weight: (59) Using EXCEL attempt the following questions Question 1:

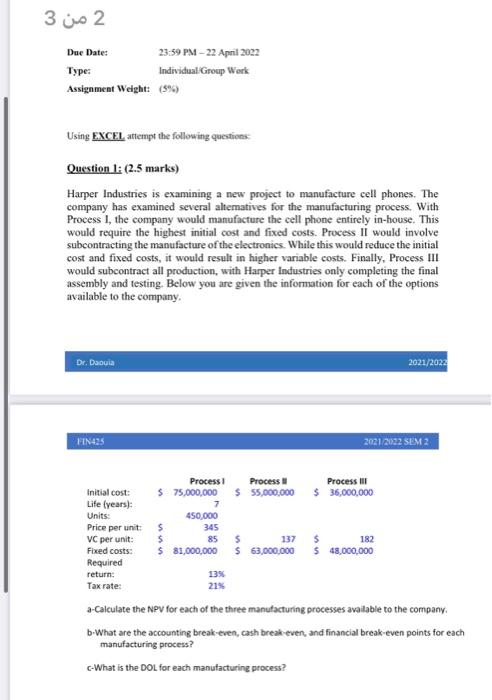

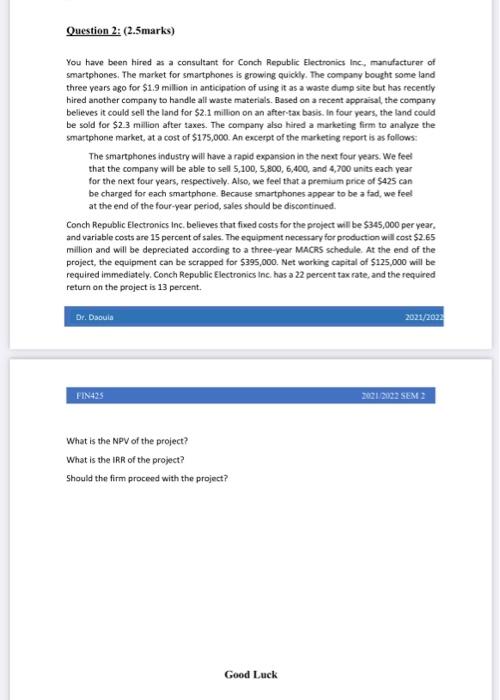

2 3 Due Date: 23:59 PM - 22 April 2022 Type: Individual Group Werk Assignment Weight: (59) Using EXCEL attempt the following questions Question 1: (2.5 marks) Harper Industries is examining a new project to manufacture cell phones. The company has examined several alteratives for the manufacturing process. With Process I, the company would manufacture the cell phone entirely in-house. This would require the highest initial cost and fixed costs. Process II would involve subcontracting the manufacture of the electronics. While this would reduce the initial cost and fixed costs, it would result in higher variable costs. Finally, Process III would subcontract all production, with Harper industries only completing the final assembly and testing. Below you are given the information for each of the options available to the company. Dr. Dacia 2021/2022 FIN425 2021/2022 SEM 2 Process $ 55,000,000 Process III $ 35,000,000 Initial cost: Life (years): Units: Price per unit: VC per unit: Fixed costs: Required return: Tax rate: Processi $ 75,000,000 7 450.000 $ 345 $ 85 $ 81,000,000 13% 215 $ 1375 182 $ 63,000,000 $ 48,000,000 3-Calculate the NPV for each of the three manufacturing processes available to the company, b-What are the accounting break-even, cash break even, and financial break-even points for each manufacturing process? c-What is the DOL for each manufacturing process? Question 2: (2.5marks) You have been hired as a consultant for Conch Republic Electronics Inc., manufacturer of smartphones. The market for smartphones is growing quickly. The company bought some land three years ago for $1.9 million in anticipation of using it as a waste dump site but has recently hired another company to handle all waste materials. Based on a recent appraisal the company believes it could sell the land for $2.1 million on an after-tax basis. In four years, the land could be sold for $2.3 million after taxes. The company also hired a marketing firm to analyze the smartphone market, at a cost of $175,000. An excerpt of the marketing report is as follows: The smartphones industry will have a rapid expansion in the next four years. We feel that the company will be able to sell 5,100,5,800, 6,400, and 4,700 units each year for the next four years, respectively. Also, we feel that a premium price of $425 can be charged for each smartphone. Because smartphones appear to be a fad, we feet at the end of the four-year period, sales should be discontinued Conch Republic Electronics Inc believes that fixed costs for the project will be $345,000 per year. and variable costs are 15 percent of sales. The equipment necessary for production will cost $2.65 million and will be depreciated according to a three-year MACRS schedule. At the end of the project, the equipment can be scrapped for $395,000. Net working capital of $125,000 will be required immediately. Conch Republic Electronics Inc. has a 22 percent tax rate, and the required return on the project is 13 percent. Dr. Daoula 2021/2023 FIN4S 2021/2022 SEM What is the NPV of the project? What is the IRR of the project? Should the firm proceed with the project? Good Luck 2 3 Due Date: 23:59 PM - 22 April 2022 Type: Individual Group Werk Assignment Weight: (59) Using EXCEL attempt the following questions Question 1: (2.5 marks) Harper Industries is examining a new project to manufacture cell phones. The company has examined several alteratives for the manufacturing process. With Process I, the company would manufacture the cell phone entirely in-house. This would require the highest initial cost and fixed costs. Process II would involve subcontracting the manufacture of the electronics. While this would reduce the initial cost and fixed costs, it would result in higher variable costs. Finally, Process III would subcontract all production, with Harper industries only completing the final assembly and testing. Below you are given the information for each of the options available to the company. Dr. Dacia 2021/2022 FIN425 2021/2022 SEM 2 Process $ 55,000,000 Process III $ 35,000,000 Initial cost: Life (years): Units: Price per unit: VC per unit: Fixed costs: Required return: Tax rate: Processi $ 75,000,000 7 450.000 $ 345 $ 85 $ 81,000,000 13% 215 $ 1375 182 $ 63,000,000 $ 48,000,000 3-Calculate the NPV for each of the three manufacturing processes available to the company, b-What are the accounting break-even, cash break even, and financial break-even points for each manufacturing process? c-What is the DOL for each manufacturing process? Question 2: (2.5marks) You have been hired as a consultant for Conch Republic Electronics Inc., manufacturer of smartphones. The market for smartphones is growing quickly. The company bought some land three years ago for $1.9 million in anticipation of using it as a waste dump site but has recently hired another company to handle all waste materials. Based on a recent appraisal the company believes it could sell the land for $2.1 million on an after-tax basis. In four years, the land could be sold for $2.3 million after taxes. The company also hired a marketing firm to analyze the smartphone market, at a cost of $175,000. An excerpt of the marketing report is as follows: The smartphones industry will have a rapid expansion in the next four years. We feel that the company will be able to sell 5,100,5,800, 6,400, and 4,700 units each year for the next four years, respectively. Also, we feel that a premium price of $425 can be charged for each smartphone. Because smartphones appear to be a fad, we feet at the end of the four-year period, sales should be discontinued Conch Republic Electronics Inc believes that fixed costs for the project will be $345,000 per year. and variable costs are 15 percent of sales. The equipment necessary for production will cost $2.65 million and will be depreciated according to a three-year MACRS schedule. At the end of the project, the equipment can be scrapped for $395,000. Net working capital of $125,000 will be required immediately. Conch Republic Electronics Inc. has a 22 percent tax rate, and the required return on the project is 13 percent. Dr. Daoula 2021/2023 FIN4S 2021/2022 SEM What is the NPV of the project? What is the IRR of the project? Should the firm proceed with the project? Good Luck

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts