Question: 2 & 3 please 2. You win a 5-year contract to be the sole supplier of hardware to a business. You project the following cash

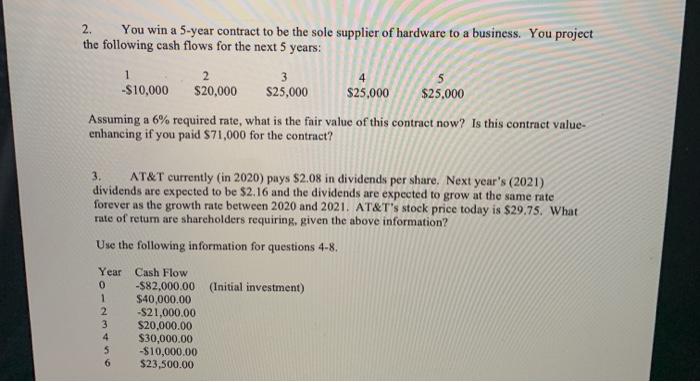

2. You win a 5-year contract to be the sole supplier of hardware to a business. You project the following cash flows for the next 5 years: 1 2 3 -$10,000 $20,000 S25,000 $25,000 $25,000 Assuming a 6% required rate, what is the fair value of this contract now? Is this contract value- enhancing if you paid $71,000 for the contract? 3. AT&T currently in 2020) pays $2.08 in dividends per share. Next year's (2021) dividends are expected to be $2.16 and the dividends are expected to grow at the same rate forever as the growth rate between 2020 and 2021. AT&T's stock price today is $29.75. What rate of retum are shareholders requiring, given the above information? Use the following information for questions 4-8. Year 0 1 2 3 4 5 6 Cash Flow -$82,000.00 (Initial investment) $40,000.00 -S21,000.00 $20,000.00 $30,000.00 -$10,000.00 $23,500.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts