Question: 2. 3. (Real interest rates: approximation method) If the real risk-free rate of interest is 5.3% and the rate of inflation is expected to be

2.

2.

3.

3.

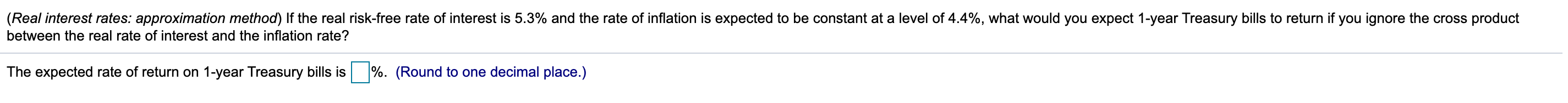

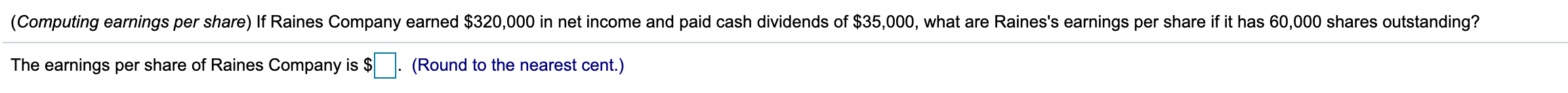

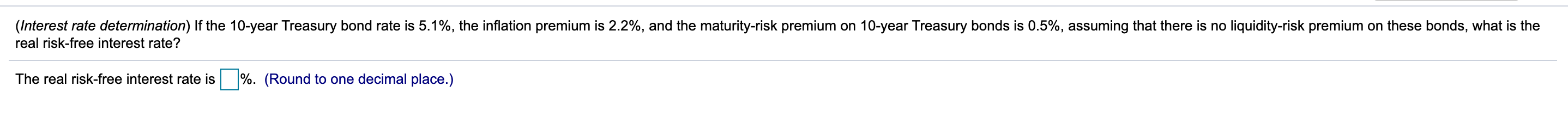

(Real interest rates: approximation method) If the real risk-free rate of interest is 5.3% and the rate of inflation is expected to be constant at a level of 4.4%, what would you expect 1-year Treasury bills to return if you ignore the cross product between the real rate of interest and the inflation rate? The expected rate of return on 1-year Treasury bills is %. (Round to one decimal place.) (Computing earnings per share) If Raines Company earned $320,000 in net income and paid cash dividends of $35,000, what are Raines's earnings per share if it has 60,000 shares outstanding? The earnings per share of Raines Company is $ (Round to the nearest cent.) (Interest rate determination) If the 10-year Treasury bond rate is 5.1%, the inflation premium is 2.2%, and the maturity-risk premium on 10-year Treasury bonds is 0.5%, assuming that there is no liquidity-risk premium on these bonds, what is the real risk-free interest rate? The real risk-free interest rate is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts