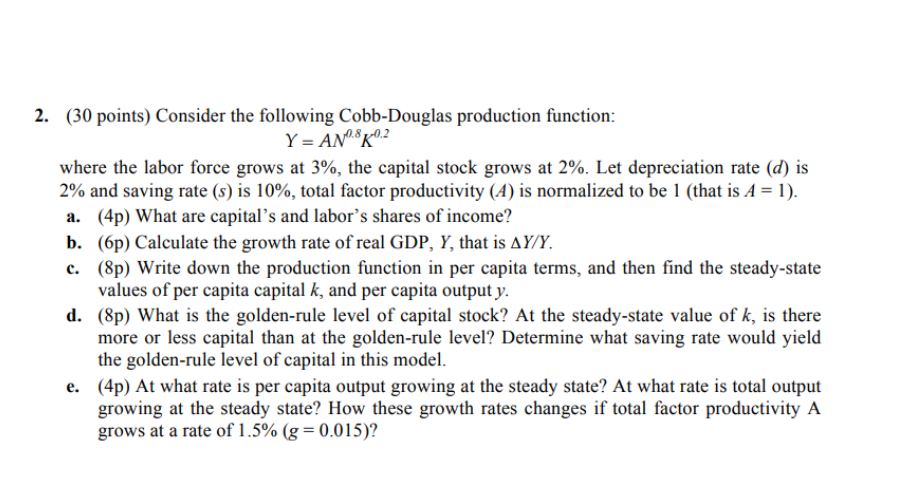

Question: 2. (30 points) Consider the following Cobb-Douglas production function: Y = AN0.8K02 where the labor force grows at 3%, the capital stock grows at 2%.

2. (30 points) Consider the following Cobb-Douglas production function: Y = AN0.8K02 where the labor force grows at 3%, the capital stock grows at 2%. Let depreciation rate (d) is 2% and saving rate (s) is 10%, total factor productivity (A) is normalized to be 1 (that is A = 1). a. (4) What are capital's and labor's shares of income? b. (6p) Calculate the growth rate of real GDP, Y, that is AY/Y. c. (8p) Write down the production function in per capita terms, and then find the steady-state values of per capita capital k, and per capita output y. d. (Sp) What is the golden-rule level of capital stock? At the steady-state value of k, is there more or less capital than at the golden-rule level? Determine what saving rate would yield the golden-rule level of capital in this model. e. (4p) At what rate is per capita output growing at the steady state? At what rate is total output growing at the steady state? How these growth rates changes if total factor productivity A grows at a rate of 1.5% (g = 0.015)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts