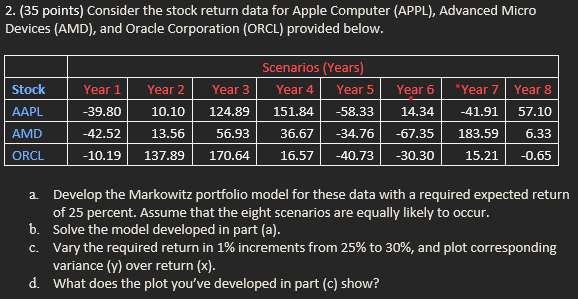

Question: 2. (35 points) Consider the stock return data for Apple Computer (APPL), Advanced Micro Devices (AMD), and Oracle Corporation (ORCL) provided below. Scenarios (Years)

2. (35 points) Consider the stock return data for Apple Computer (APPL), Advanced Micro Devices (AMD), and Oracle Corporation (ORCL) provided below. Scenarios (Years) Stock Year 1 Year 2 Year 3 AAPL -39.80 10.10 124.89 Year 4 151.84 Year 5 Year 6 *Year 7 Year 8 -58.33 14.34 -41.91 57.10 AMD -42.52 ORCL -10.19 13.56 56.93 137.89 170.64 36.67 -34.76 -67.35 183.59 6.33 16.57 -40.73 -30.30 15.21 -0.65 a. Develop the Markowitz portfolio model for these data with a required expected return of 25 percent. Assume that the eight scenarios are equally likely to occur. b. Solve the model developed in part (a). c. Vary the required return in 1% increments from 25% to 30%, and plot corresponding variance (y) over return (x). d. What does the plot you've developed in part (c) show?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts