Question: 2. (35 points total) -> Use the data in (b), write an AMPL code to find the minimum ADR portfolio in which rp is >

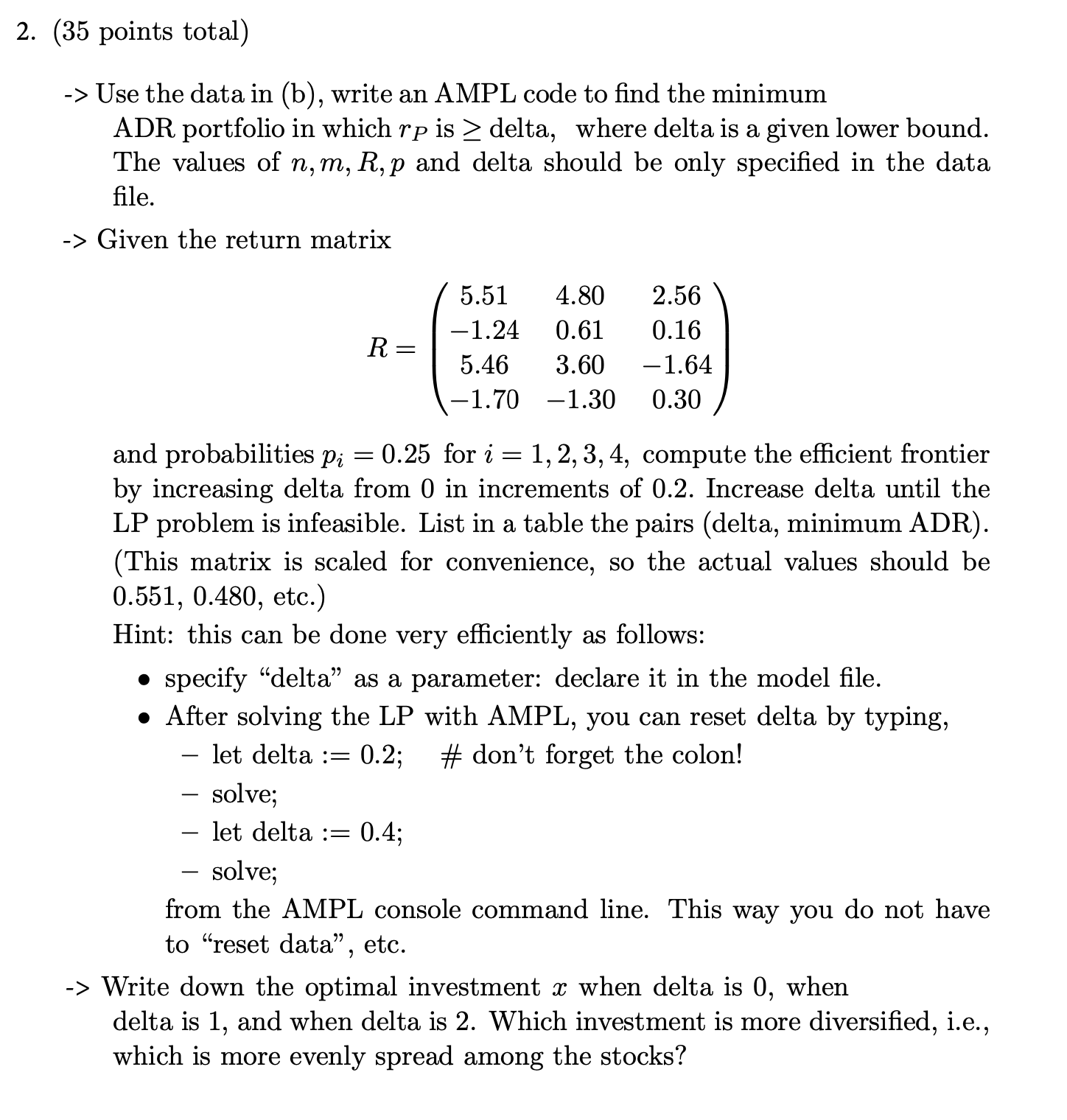

2. (35 points total) -> Use the data in (b), write an AMPL code to find the minimum ADR portfolio in which rp is > delta, where delta is a given lower bound. The values of n, m, R, p and delta should be only specified in the data file. -> Given the return matrix 5.51 4.80 2.56 -1.24 0.61 0.16 R = 5.46 3.60 -1.64 -1.70 -1.30 0.30 and probabilities pi = 0.25 for i = 1, 2, 3, 4, compute the efficient frontier by increasing delta from 0 in increments of 0.2. Increase delta until the LP problem is infeasible. List in a table the pairs (delta, minimum ADR). (This matrix is scaled for convenience, so the actual values should be 0.551, 0.480, etc.) Hint: this can be done very efficiently as follows: . specify "delta" as a parameter: declare it in the model file. . After solving the LP with AMPL, you can reset delta by typing, - let delta := 0.2; # don't forget the colon! - solve; - let delta := 0.4; solve; from the AMPL console command line. This way you do not have to "reset data", etc. -> Write down the optimal investment x when delta is 0, when delta is 1, and when delta is 2. Which investment is more diversified, i.e., which is more evenly spread among the stocks?2. (35 points total) -> Use the data in (b), write an AMPL code to find the minimum ADR portfolio in which rp is > delta, where delta is a given lower bound. The values of n, m, R, p and delta should be only specified in the data file. -> Given the return matrix 5.51 4.80 2.56 -1.24 0.61 0.16 R = 5.46 3.60 -1.64 -1.70 -1.30 0.30 and probabilities pi = 0.25 for i = 1, 2, 3, 4, compute the efficient frontier by increasing delta from 0 in increments of 0.2. Increase delta until the LP problem is infeasible. List in a table the pairs (delta, minimum ADR). (This matrix is scaled for convenience, so the actual values should be 0.551, 0.480, etc.) Hint: this can be done very efficiently as follows: . specify "delta" as a parameter: declare it in the model file. . After solving the LP with AMPL, you can reset delta by typing, - let delta := 0.2; # don't forget the colon! - solve; - let delta := 0.4; solve; from the AMPL console command line. This way you do not have to "reset data", etc. -> Write down the optimal investment x when delta is 0, when delta is 1, and when delta is 2. Which investment is more diversified, i.e., which is more evenly spread among the stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts