Question: 2. (3pt) Consider a 3-year annual level premium term life insurance on (40). The death benefit is 1000, payable at the end of the year

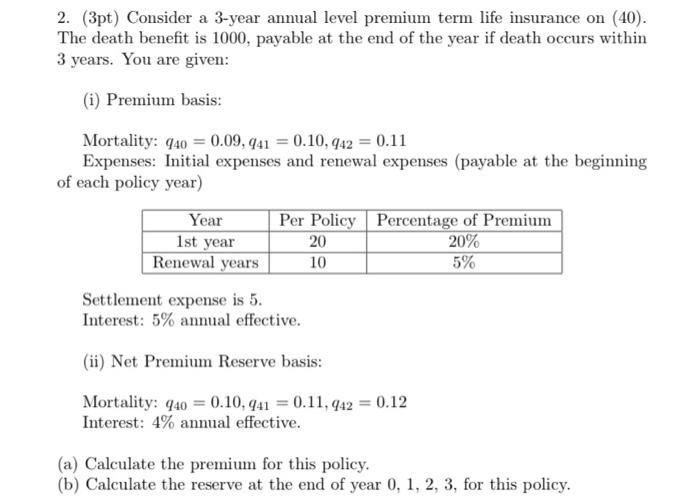

2. (3pt) Consider a 3-year annual level premium term life insurance on (40). The death benefit is 1000, payable at the end of the year if death occurs within 3 years. You are given: (i) Premium basis: Mortality: 940 = 0.09,941 = 0.10,442 = 0.11 Expenses: Initial expenses and renewal expenses (payable at the beginning of each policy year) Year Per Policy Percentage of Premium 1st year 20 20% Renewal years 10 5% Settlement expense is 5. Interest: 5% annual effective. (ii) Net Premium Reserve basis: Mortality: 940 = 0.10,441 = 0.11,942 = 0.12 Interest: 4% annual effective. (a) Calculate the premium for this policy. (b) Calculate the reserve at the end of year 0, 1, 2, 3, for this policy. 2. (3pt) Consider a 3-year annual level premium term life insurance on (40). The death benefit is 1000, payable at the end of the year if death occurs within 3 years. You are given: (i) Premium basis: Mortality: 940 = 0.09,941 = 0.10,442 = 0.11 Expenses: Initial expenses and renewal expenses (payable at the beginning of each policy year) Year Per Policy Percentage of Premium 1st year 20 20% Renewal years 10 5% Settlement expense is 5. Interest: 5% annual effective. (ii) Net Premium Reserve basis: Mortality: 940 = 0.10,441 = 0.11,942 = 0.12 Interest: 4% annual effective. (a) Calculate the premium for this policy. (b) Calculate the reserve at the end of year 0, 1, 2, 3, for this policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts