Question: 2 : 4 0 Assignment Details Back BUS 3 1 1 I - CORPORATE FINANCE Assignment Requirement 1 Q 3 - 1 Consider the following

:

Assignment Details

Back

BUS I CORPORATE FINANCE

Assignment Requirement

Q

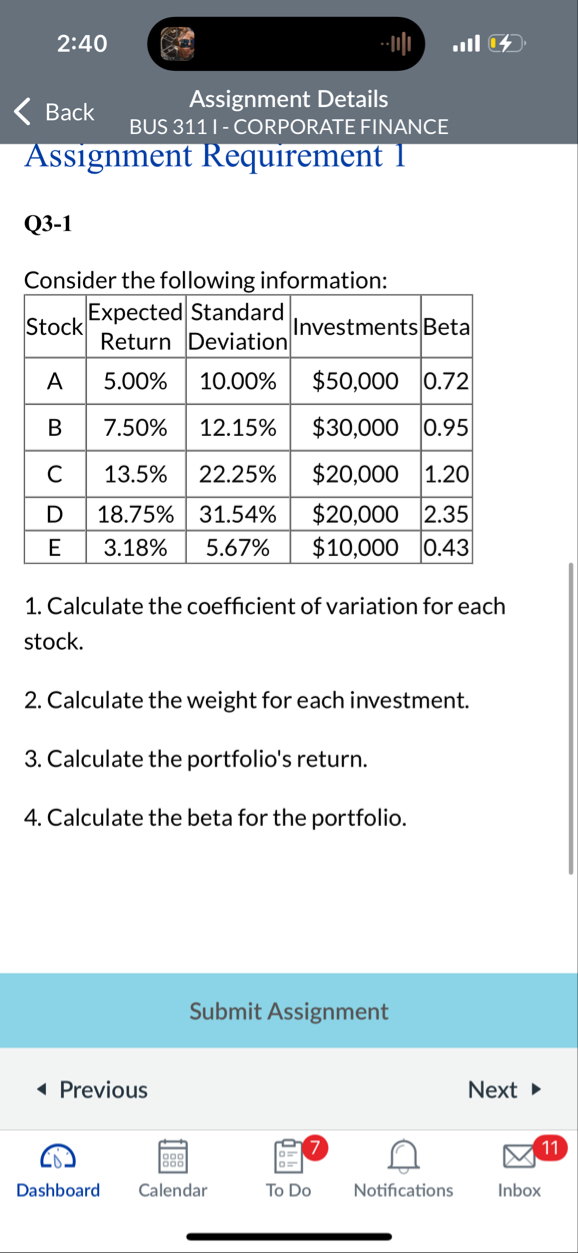

Consider the following information:

tableStocktableExpectedReturntableStandardDeviationInvestments,BetaA$B$C$D$E$

Calculate the coefficient of variation for each stock.

Calculate the weight for each investment.

Calculate the portfolio's return.

Calculate the beta for the portfolio.

Submit Assignment

Previous

Next

Dashboard

Calendar

To Do

Notifications

Inbox

:

Assignment Details

Back

BUS I CORPORATE FINANCE

Assignment Requirement

Q

Consider the following information:

tableStocktableExpectedReturntableStandardDeviationInvestments,BetaA$B$C$D$E$

Calculate the coefficient of variation for each stock.

Calculate the weight for each investment.

Calculate the portfolio's return.

Calculate the beta for the portfolio.

Submit Assignment

Previous

Next

Dashboard

Calendar

To Do

Notifications

Inbox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock