Question: 2 : 4 8 PM Sat Apr 5 - 3 9 % 6 0 5 Assignment.pdf Ouestion ( 2 quad )

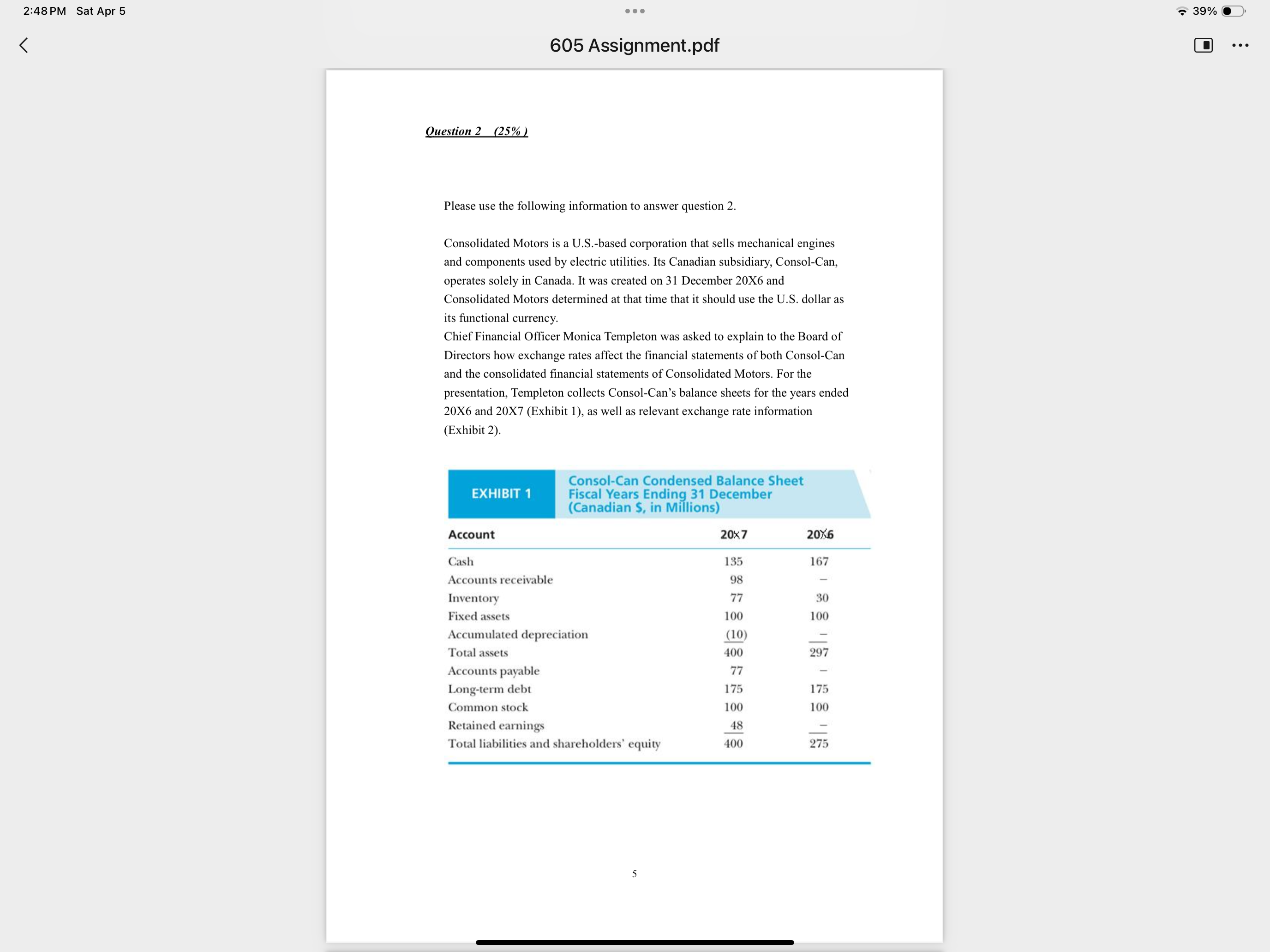

: PM Sat Apr Assignment.pdf Ouestion quad Please use the following information to answer question Consolidated Motors is a USbased corporation that sells mechanical engines and components used by electric utilities. Its Canadian subsidiary, ConsolCan, operates solely in Canada. It was created on December X and Consolidated Motors determined at that time that it should use the US dollar as its functional currency. Chief Financial Officer Monica Templeton was asked to explain to the Board of Directors how exchange rates affect the financial statements of both ConsolCan and the consolidated financial statements of Consolidated Motors. For the presentation, Templeton collects ConsolCan's balance sheets for the years ended X and XExhibit as well as relevant exchange rate information Exhibit begintabularccchline begintabularl ConsolCan Con EXHIBIT Fiscal Years End Canadian $ in endtabular & multicolumnlConsolCan Condensed Balance Sheet Fiscal Years Ending December Canadian $ in Millionshline Account & & hline Cash & & hline Accounts receivable & & hline Inventory & & hline Fixed assets & & hline Accumulated depreciation & & hline Total assets & & hline Accounts payable & & hline Longterm debt & & hline Common stock & & hline Retained earnings & & hline Total liabilities and shareholders' equity & & hline endtabular

US$Canadian $

Rate on December x

Average rate in

Weighted average rate for inventory purchases

begintabularll

Rate on December &

hline

endtabular

Templeton explains that ConsolCan uses the FIFO inventory accounting method, and that purchases of mathrmC$ million and the sellthrough of that inventory occurred evenly throughout X Her presentation includes reporting the translated amounts in US currency for each item, as well as associated translationrelated gains and losses. The Board responds with several questions.

Question Would there be a reason to change the functional currency to the Canadian dollar?

Question :Would there be any translation effects for Consolidated Motors if the functional currency for ConsolCan were changed to the Canadian dollar?

Question : Would a change in the functional currency have any impact on financial statement ratios for the parent company?

Question : What would be the balance sheet exposure to translation effects if the functional currency were changed?

a After translating ConsolCan's inventory and longterm debt into the parent currency US$ what would be the amounts to be included on Consolidated Motor's financial statements at December X

b After translating ConsolCan's December X balance sheet into the parent currency, what is the translated value of retained earnings assuming no dividend payment throughout X

c In response to the Board's first question, When should Templeton justify such a change?

d In response to the Board's fourth question, what would be the balance sheet exposure in Canadian Dollar

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock