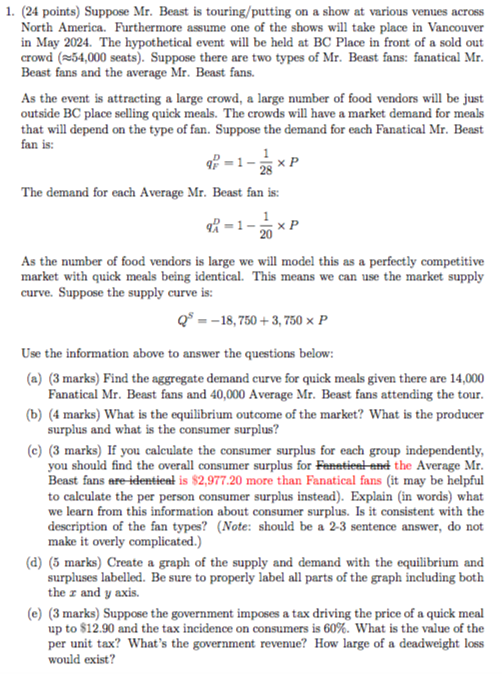

Question: ( 2 4 points ) Suppose Mr . Beast is touring / putting on a show at various venues across North America. Furthermore assume one

points Suppose Mr Beast is touringputting on a show at various venues across

North America. Furthermore assume one of the shows will take place in Vancouver

in May The hypothetical event will be held at BC Place in front of a sold out

crowd ~~ seats Suppose there are two types of Mr Beast fans: fanatical Mr

Beast fans and the average Mr Beast fans.

As the event is attracting a large crowd, a large number of food vendors will be just

outside place selling quick meals. The crowds will have a market demand for meals

that will depend on the type of fan. Suppose the demand for each Fanatical Mr Beast

fan is:

The demand for each Average Mr Beast fan is:

As the number of food vendors is large we will model this as a perfectly competitive

market with quick meals being identical. This means we can use the market supply

curve. Suppose the supply curve is:

Use the information above to answer the questions below:

a marks Find the aggregate demand curve for quick meals given there are

Fanatical Mr Beast fans and Average Mr Beast fans attending the tour.

b marks What is the equilibrium outcome of the market? What is the producer

surplus and what is the consumer surplus?

c marks If you calculate the consumer surplus for each group independently,

you should find the overall consumer surplus for Fentieel and the Average Mr

Beast fans are identient is $ more than Fanatical fans it may be helpful

to calculate the per person consumer surplus instead Explain in words what

we learn from this information about consumer surplus. Is it consistent with the

description of the fan types? Note: should be a sentence answer, do not

make it overly complicated.

d marks Create a graph of the supply and demand with the equilibrium and

surpluses labelled. Be sure to properly label all parts of the graph including both

the and axis.

e marks Suppose the government imposes a tax driving the price of a quick meal

up to $ and the tax incidence on consumers is What is the value of the

per unit tax? What's the government revenue? How large of a deadweight loss

would exist?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock