Question: 2. (40 points) Consider an overlapping generations model in which consumers live for two periods. The number of people born in each generation grows in

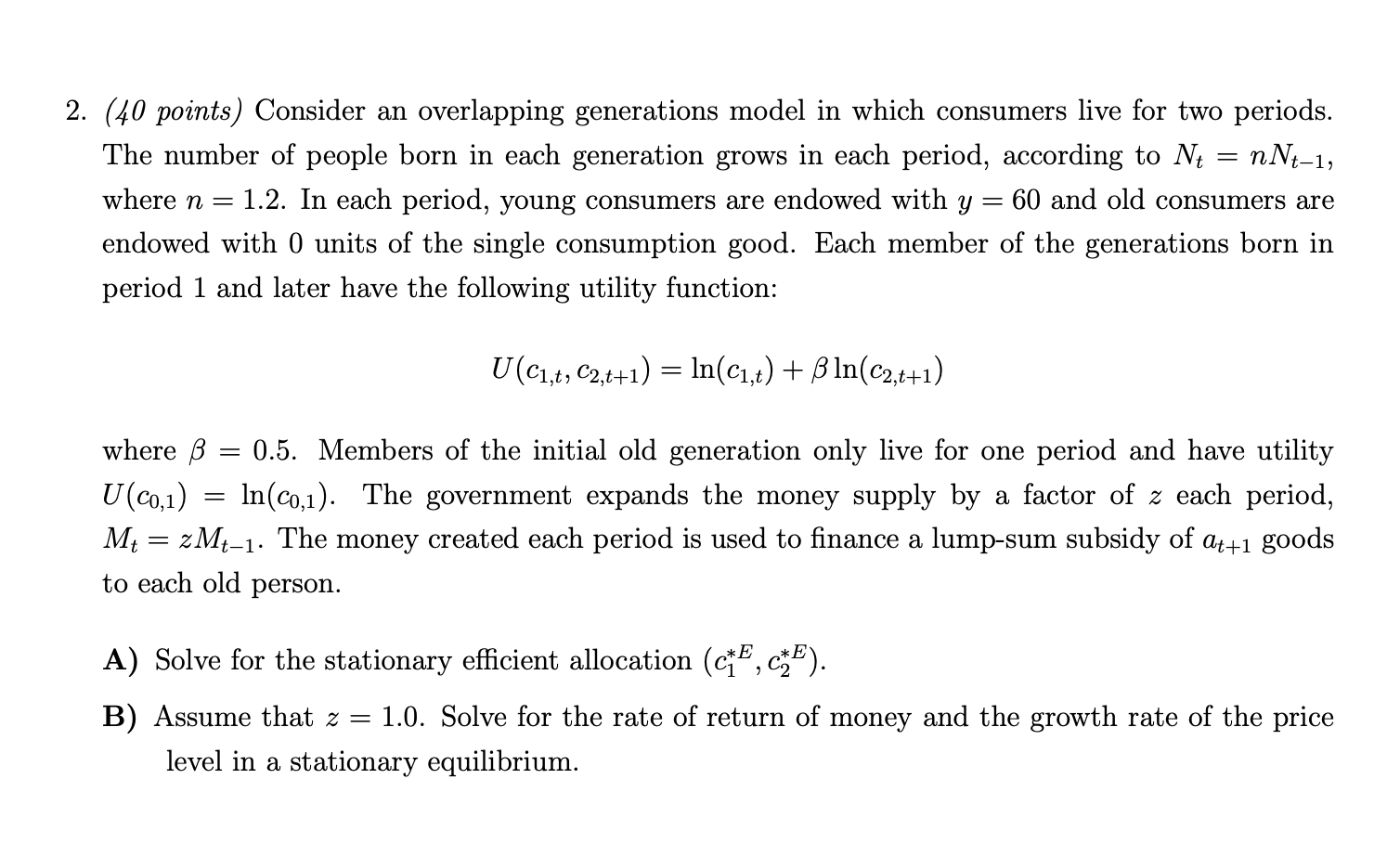

2. (40 points) Consider an overlapping generations model in which consumers live for two periods. The number of people born in each generation grows in each period, according to Nt = nNt-1, where n= 1.2. In each period, young consumers are endowed with y= 60 and old consumers are endowed with 0 units of the single consumption good. Each member of the generations born in period 1 and later have the following utility function: U(C1.6, C2,411) = ln(C1.t) + Bln(C2,411) = where 0.5. Members of the initial old generation only live for one period and have utility U(C0,1) In(C0,1). The government expands the money supply by a factor of z each period, M+ = zMt-1. The money created each period is used to finance a lump-sum subsidy of at+1 goods to each old person. A) Solve for the stationary efficient allocation (c*F, ct.). B) Assume that z = 1.0. Solve for the rate of return of money and the growth rate of the price level in a stationary equilibrium. 2. (40 points) Consider an overlapping generations model in which consumers live for two periods. The number of people born in each generation grows in each period, according to Nt = nNt-1, where n= 1.2. In each period, young consumers are endowed with y= 60 and old consumers are endowed with 0 units of the single consumption good. Each member of the generations born in period 1 and later have the following utility function: U(C1.6, C2,411) = ln(C1.t) + Bln(C2,411) = where 0.5. Members of the initial old generation only live for one period and have utility U(C0,1) In(C0,1). The government expands the money supply by a factor of z each period, M+ = zMt-1. The money created each period is used to finance a lump-sum subsidy of at+1 goods to each old person. A) Solve for the stationary efficient allocation (c*F, ct.). B) Assume that z = 1.0. Solve for the rate of return of money and the growth rate of the price level in a stationary equilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts