Question: 2) (45 points) Consider a monthly binomial price process with u = 1.10 and d = 0.90 for some stock where the monthly interest rate

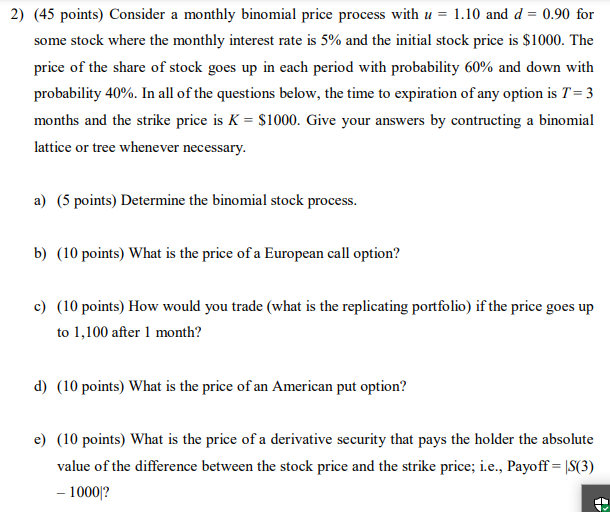

2) (45 points) Consider a monthly binomial price process with u = 1.10 and d = 0.90 for some stock where the monthly interest rate is 5% and the initial stock price is $1000. The price of the share of stock goes up in each period with probability 60% and down with probability 40%. In all of the questions below, the time to expiration of any option is T= 3 months and the strike price is K = $1000. Give your answers by contructing a binomial lattice or tree whenever necessary. a) (5 points) Determine the binomial stock process. b) (10 points) What is the price of a European call option? c) (10 points) How would you trade (what is the replicating portfolio) if the price goes up to 1,100 after 1 month? d) (10 points) What is the price of an American put option? e) (10 points) What is the price of a derivative security that pays the holder the absolute value of the difference between the stock price and the strike price; i.e., Payoff = |S(3) - 1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts