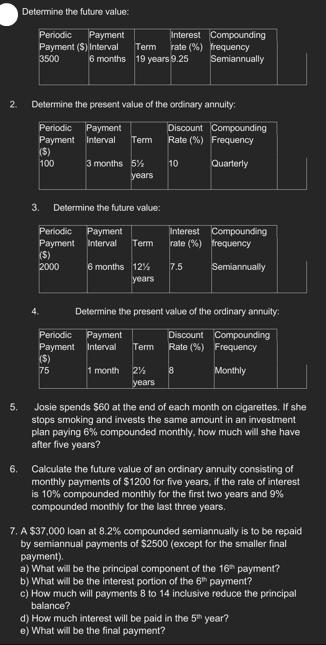

Question: 2. 5. 6. Determine the future value: Periodic Payment Payment ($) Interval 3500 ($) 100 Determine the present value of the ordinary annuity: Periodic

2. 5. 6. Determine the future value: Periodic Payment Payment ($) Interval 3500 ($) 100 Determine the present value of the ordinary annuity: Periodic Payment Payment Interval Term 3. ($) 2000 4. Interest Term rate (%) 6 months 19 years 9.25 Periodic Payment Payment Periodic Payment ($) 75 3 months 5% Determine the future value: years Discount Compounding Rate (%) Frequency Quarterly 10 Interval Term rate (%) 6 months 12% 7.5 years 2 years Compounding frequency Semiannually est Compounding frequency Semiannually Determine the present value of the ordinary annuity: Payment Discount Compounding Frequency Interval 1 month Monthly Term Rate (%) 8 Josie spends $60 at the end of each month on cigarettes. If she stops smoking and invests the same amount in an investment plan paying 6% compounded monthly, how much will she have after five years? Calculate the future value of an ordinary annuity consisting of monthly payments of $1200 for five years, if the rate of interest is 10% compounded monthly for the first two years and 9% compounded monthly for the last three years. 7. A $37,000 loan at 8.2% compounded semiannually is to be repaid by semiannual payments of $2500 (except for the smaller final payment). a) What will be the principal component of the 16th payment? b) What will be the interest portion of the 6th payment? c) How much will payments 8 to 14 inclusive reduce the principal balance? d) How much interest will be paid in the 5th year? e) What will be the final payment?

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

ANSWER 1 The future value is 35802236 2 The present value of the ordinary annuity is 886889 3 The future value is 20065245 4 The present value of the ... View full answer

Get step-by-step solutions from verified subject matter experts