Question: 2 / 5 90% + OS Topic 10: The Shadow Banking System 1. Define what is the shadow banking system. Briefly describe the main differences

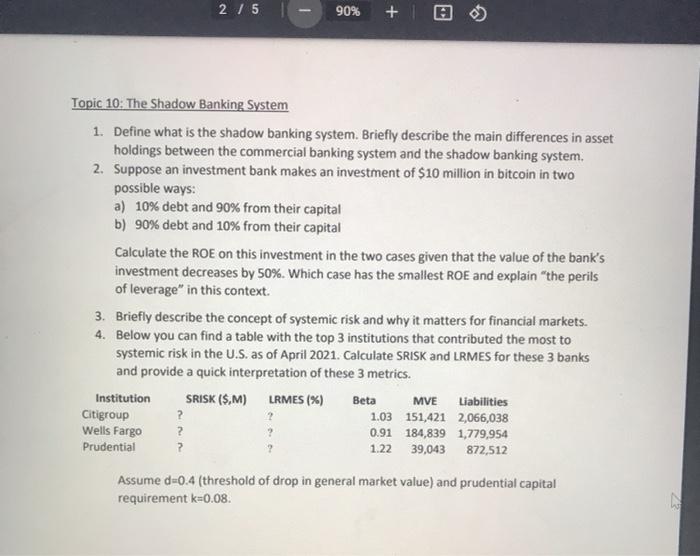

2 / 5 90% + OS Topic 10: The Shadow Banking System 1. Define what is the shadow banking system. Briefly describe the main differences in asset holdings between the commercial banking system and the shadow banking system 2. Suppose an investment bank makes an investment of $10 million in bitcoin in two possible ways: a) 10% debt and 90% from their capital b) 90% debt and 10% from their capital Calculate the ROE on this investment in the two cases given that the value of the bank's investment decreases by 50%. Which case has the smallest ROE and explain the perils of leverage" in this context. 3. Briefly describe the concept of systemic risk and why it matters for financial markets. 4. Below you can find a table with the top 3 institutions that contributed the most to systemic risk in the U.S. as of April 2021. Calculate SRISK and LRMES for these 3 banks and provide a quick interpretation of these 3 metrics. Institution SRISK (S,M) LRMES (%) Beta MVE Liabilities Citigroup ? 1.03 151,421 2,066,038 Wells Fargo ? 0.91 184,839 1,779,954 Prudential 2 1.22 39,043 872,512 2 ? Assume d=0.4 (threshold of drop in general market value) and prudential capital requirement k=0.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts