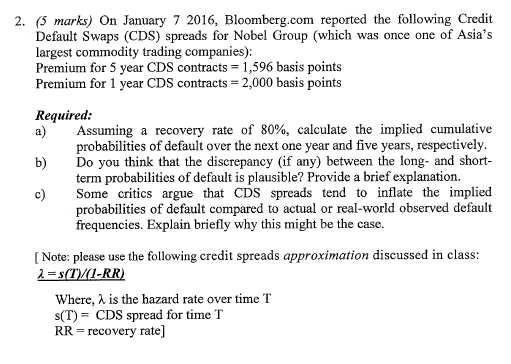

Question: 2. (5 marks) On January 7 2016, Bloomberg.com reported the following Credit Default Swaps (CDS) spreads for Nobel Group (which was once one of Asia's

2. (5 marks) On January 7 2016, Bloomberg.com reported the following Credit Default Swaps (CDS) spreads for Nobel Group (which was once one of Asia's largest commodity trading companies): Premium for 5 year CDS contracts- 1,596 basis points Premium for 1 year CDS contracts 2,000 basis points Required: a) Assuming a recovery rate of 80%, calculate the implied cumulative probabilities of default over the next one year and five years, respectively Do you think that the discrepancy (if any) between the long- and short- term probabilities of default is plausible? Provide a brief explanation. b) c Some critics argue that CDS spreads tend to inflate the implied probabilities of default compared to actual or real-world observed default frequencies. Explain briefly why this might be the case. [Note: please use the following credit spreads where, is the hazard rate over time T s(T) CDS spread for time T RR-recovery rate] 2. (5 marks) On January 7 2016, Bloomberg.com reported the following Credit Default Swaps (CDS) spreads for Nobel Group (which was once one of Asia's largest commodity trading companies): Premium for 5 year CDS contracts- 1,596 basis points Premium for 1 year CDS contracts 2,000 basis points Required: a) Assuming a recovery rate of 80%, calculate the implied cumulative probabilities of default over the next one year and five years, respectively Do you think that the discrepancy (if any) between the long- and short- term probabilities of default is plausible? Provide a brief explanation. b) c Some critics argue that CDS spreads tend to inflate the implied probabilities of default compared to actual or real-world observed default frequencies. Explain briefly why this might be the case. [Note: please use the following credit spreads where, is the hazard rate over time T s(T) CDS spread for time T RR-recovery rate]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts