Question: 2. (5 points) A company has $20 billion of sales and $1 billion of net income. Its total assets are $10 billion. The company's total

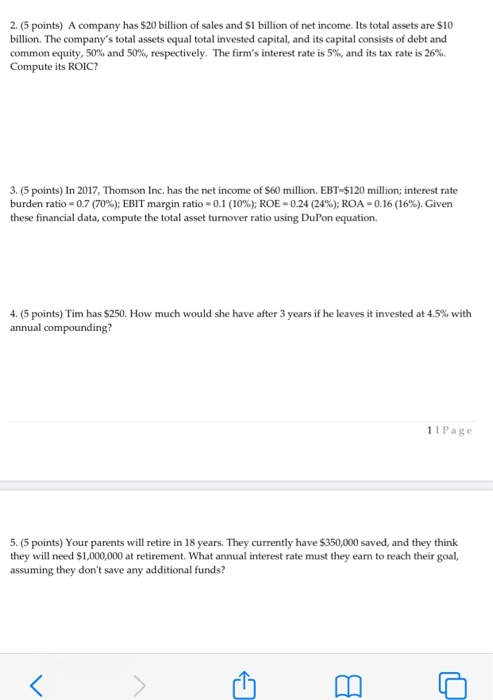

2. (5 points) A company has $20 billion of sales and $1 billion of net income. Its total assets are $10 billion. The company's total assets equal total invested capital, and its capital consists of debt and common equity, 50% and 50%, respectively. The firm's interest rate is 5% and its tax rate is 26% Compute its ROIC? 17, Thomson Inc. has the net income of $60 million. EBT-$120 million; interest rate burden ratio - 0.7 (70%); EBIT margin ratio -0.1 (10%); ROE -0.24 (24%); ROA-0.16 (16%). Given these financial data, compute the total asset turnover ratio using DuPon equation. 4. (5 points) Tim has $250. How much would she have after 3 years if he leaves it invested at 4.5% with annual compounding? 1 1 Page 5. (5 points) Your parents will retire in 18 years. They currently have $350,000 saved, and they think they will need $1,000,000 at retirement. What annual interest rate must they eam to reach their goal, assuming they don't save any additional funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts