Question: 2 (5 Points). A great white shark is attacking the people of a New Jersey Beach Town. A local fisherman has offered to kill the

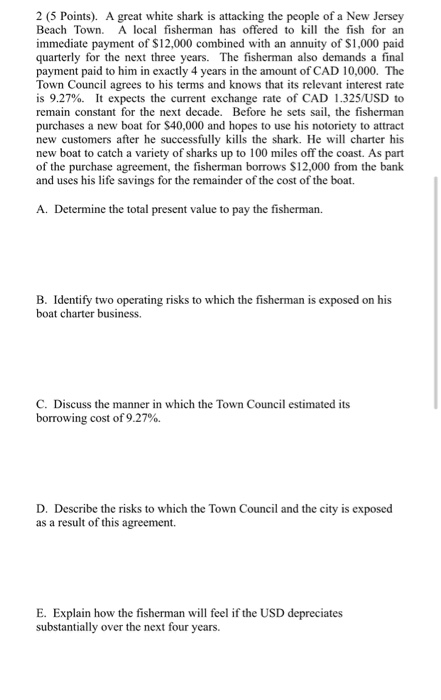

2 (5 Points). A great white shark is attacking the people of a New Jersey Beach Town. A local fisherman has offered to kill the fish for an immediate payment of $12,000 combined with an annuity of $1,000 paid quarterly for the next three years. The fisherman also demands a final payment paid to him in exactly 4 years in the amount of CAD 10,000. The Town Council agrees to his terms and knows that its relevant interest rate is 9.27%. It expects the current exchange rate of CAD 1.325/USD to remain constant for the next decade. Before he sets sail, the fisherman purchases a new boat for S40,000 and hopes to use his notoriety to attract new customers after he successfully kills the shark. He will charter his new boat to catch a variety of sharks up to 100 miles off the coast. As part of the purchase agreement, the fisherman borrows $12,000 from the bank and uses his life savings for the remainder of the cost of the boat. A. Determine the total present value to pay the fisherman. B. Identify two operating risks to which the fisherman is exposed on his boat charter business. C. Discuss the manner in which the Town Council estimated its borrowing cost of 9.27%. D. Describe the risks to which the Town Council and the city is exposed as a result of this agreement. E. Explain how the fisherman will feel if the USD depreciates substantially over the next four years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts