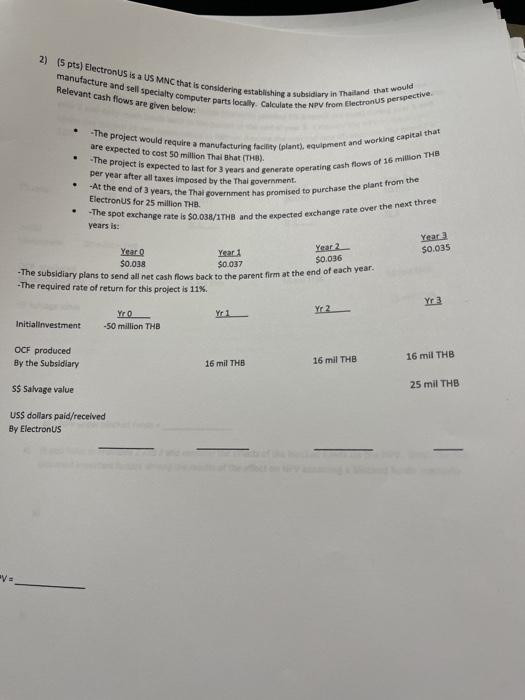

Question: 2) (5 pts) Electronus is a US MNC that is considering establishing a subsidiary in Thailand that would manufacture and sell specialty computer parts locality

2) (5 pts) Electronus is a US MNC that is considering establishing a subsidiary in Thailand that would manufacture and sell specialty computer parts locality Calculate the NPV from Electron US perspective. Relevant cash flows are given below. are expected to cost 50 million Thai Bhat (THB) . The project would require a manufacturing facility (plant), equipment and working capital that -The project is expected to last for 3 years and generate operating cash flows of 16 million THE -At the end of 3 years, the Thai government has promised to purchase the plant from the -The spot exchange rate is $0.038/1THB and the expected exchange rate over the next three years is: per year after all taxes imposed by the Thai government . Electronus for 25 million THB Year 2 $0.036 Year $0.035 Year Year 1 $0.038 $0.037 The subsidiary plans to send all net cash flows back to the parent firm at the end of each year. -The required rate of return for this project is 11% Yr 2 Initialinvestment -50 million THB Yr3 OCF produced By the Subsidiary 16 mil THB 16 mil THB 16 mil THE 25 mil THB S$ Salvage value USS dollars paid/received By ElectronUS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts