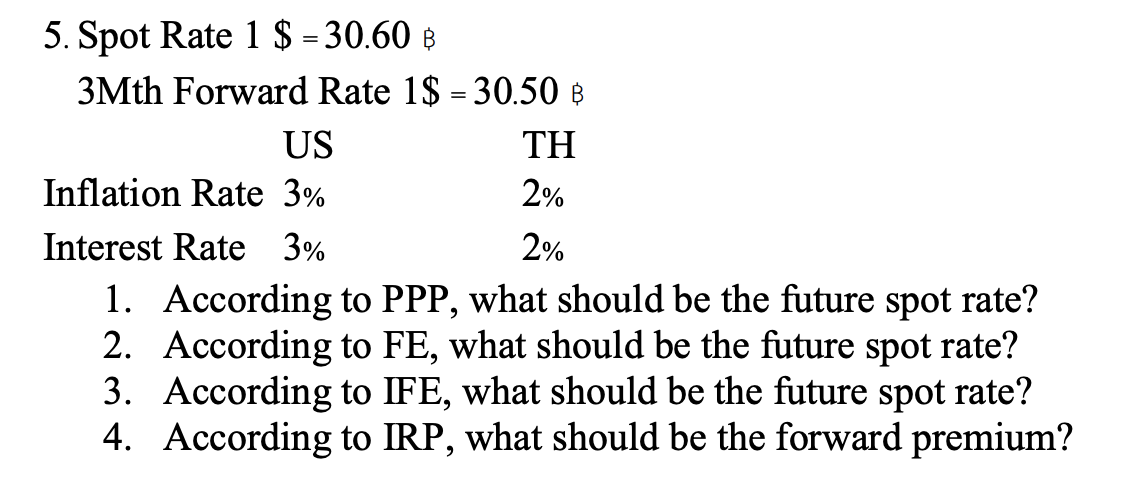

Question: 2% 5. Spot Rate 1 $ = 30.60 $ 3Mth Forward Rate 1$ = 30.50 $ US TH Inflation Rate 3% Interest Rate 3% 2%

2% 5. Spot Rate 1 $ = 30.60 $ 3Mth Forward Rate 1$ = 30.50 $ US TH Inflation Rate 3% Interest Rate 3% 2% 1. According to PPP, what should be the future spot rate? 2. According to FE, what should be the future spot rate? 3. According to IFE, what should be the future spot rate? 4. According to IRP, what should be the forward premium? > 2% 5. Spot Rate 1 $ = 30.60 $ 3Mth Forward Rate 1$ = 30.50 $ US TH Inflation Rate 3% Interest Rate 3% 2% 1. According to PPP, what should be the future spot rate? 2. According to FE, what should be the future spot rate? 3. According to IFE, what should be the future spot rate? 4. According to IRP, what should be the forward premium? >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts